|

|

|

BlinkyBill:Although this is a dick move by the developer, the issue here is that the purchaser’s lawyer has not done their job.

Also, there is no company registered called ‘Tawa LLP’, which sounds like a legal entity rather than a trading name. It would be good to understand exactly who Tawa LLP actually is. Doing a bit of looking into it it looks like the underlying company is in trouble, but I haven’t done enough to be definitive about this. It sounds like Tawa LLP is in desperate need for money.

Mikaela Wilkes should do some more work on this.

Handsomedan:

Paul1977:

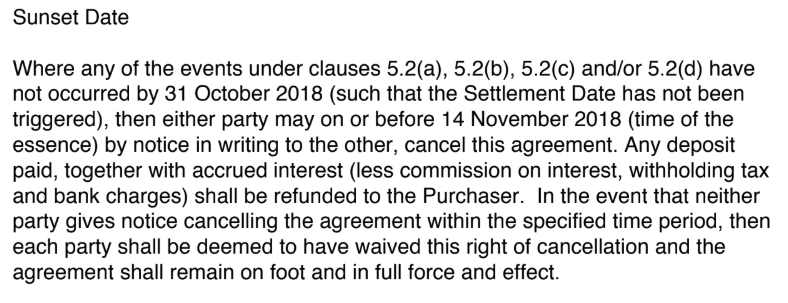

A sunset clause that allows the builder to cancel the contract sounds really dodgy to me. They could decide early on they want to pull out so they can sell for more, and then deliberately delay the build until they can make use of the clause.

EDIT: I bet a lot of people don't even get a lawyer to look over the contract.

I doubt you'd get a mortgage without a lawyer.

We got our lawyer to look over our building contract, but we never provided any evidence to the bank that we had done this and the bank never asked. The banks want a copy of the contract before they will make a final offer of finance, maybe their legal team looks over it as well?

kingdragonfly: ...Property law expert Joanna Pidgeon said a sunset clause under the Resource Management Act allows both parties to get out of an agreement if the build is not completed by a certain date.

I don't believe the RMA provides for, or envisages, any such thing.

BlinkyBill:

Although this is a dick move by the developer, the issue here is that the purchaser’s lawyer has not done their job.

I think it's both... this is a dishonest but legal move by the developer, which the purchaser's lawyer should have protected them from.

Comments along the lines of "the developer needed to do this because he was going broke" don't garner any sympathy from me. It's not the purchaser's responsibility to make good the developer's bad decisions.

I'd also comment that company liquidations are not uncommon in the property development/construction industry, and I suspect often a mechanism whereby the principal can (legally) avoid paying sub-contractors and the like, the money having already disappeared (probably legally). And if the developer is prepared to stiff the purchaser, then I'd say he'd do it to his subbies too.

[Edit] And the fact that his factory-house-building company was also liquidated reinforces this opinion. I wonder how much money it owed when it went under?

Paul1977:

We got our lawyer to look over our building contract, but we never provided any evidence to the bank that we had done this and the bank never asked. The banks want a copy of the contract before they will make a final offer of finance, maybe their legal team looks over it as well?

The bank legal team does not look over it unless requested (which is never). The lender (personal banker, mobile lending/mortgage manager etc...) is suppose to have a look at the SAP but they're not experts and generally all they look at is the vendors name, property address/legal description the price, unconditional and finance date. If you get an experienced lender they may pick up more complex things like the price excluding GST, (or curtilage which is exempt from GST).

Handsomedan:

I doubt you'd get a mortgage without a lawyer.

It is possible to use just a conveyancer.

I bought an apartment off the plans in 2016 utilising a HomeStart Grant and one of the conditions of the grant was for the S&P to have a sunset clause.

In addition to this my lawyer pointed out there wasn't one originally, and apparently had no issue with the one the developer sent through.

Another similar case on Stuff reported today.

I went and had a look at that development months ago and they appeared very close to completion. They had a couple of listings on TradeMe for places still available.

Went past again maybe two weeks ago and it looked no different (i.e basically complete) with no signs of anybody having moved in. Makes sense now from that article.

Given the developers I would steer clear myself and I'd say good dodge like the one in Wellington.

gradwefran: ….Oh and the expert quoted about the Resource Management Act containing its own sunset clause type provision is correct - there is a section in there which says that if there is a subdivision - then every sale contract is subject to a condition that it only goes ahead if that subdivision is completed. Or something like that I can't remember the wording.

But the wording is key. The RMA sunset clause does not allow the vendor to cancel a purchase agreement - it covers the purchaser in the event that a subdivision plan is not approved. It's the specific provision in the purchase agreement that provided this vendor a way out, not the RMA.

|

|

|