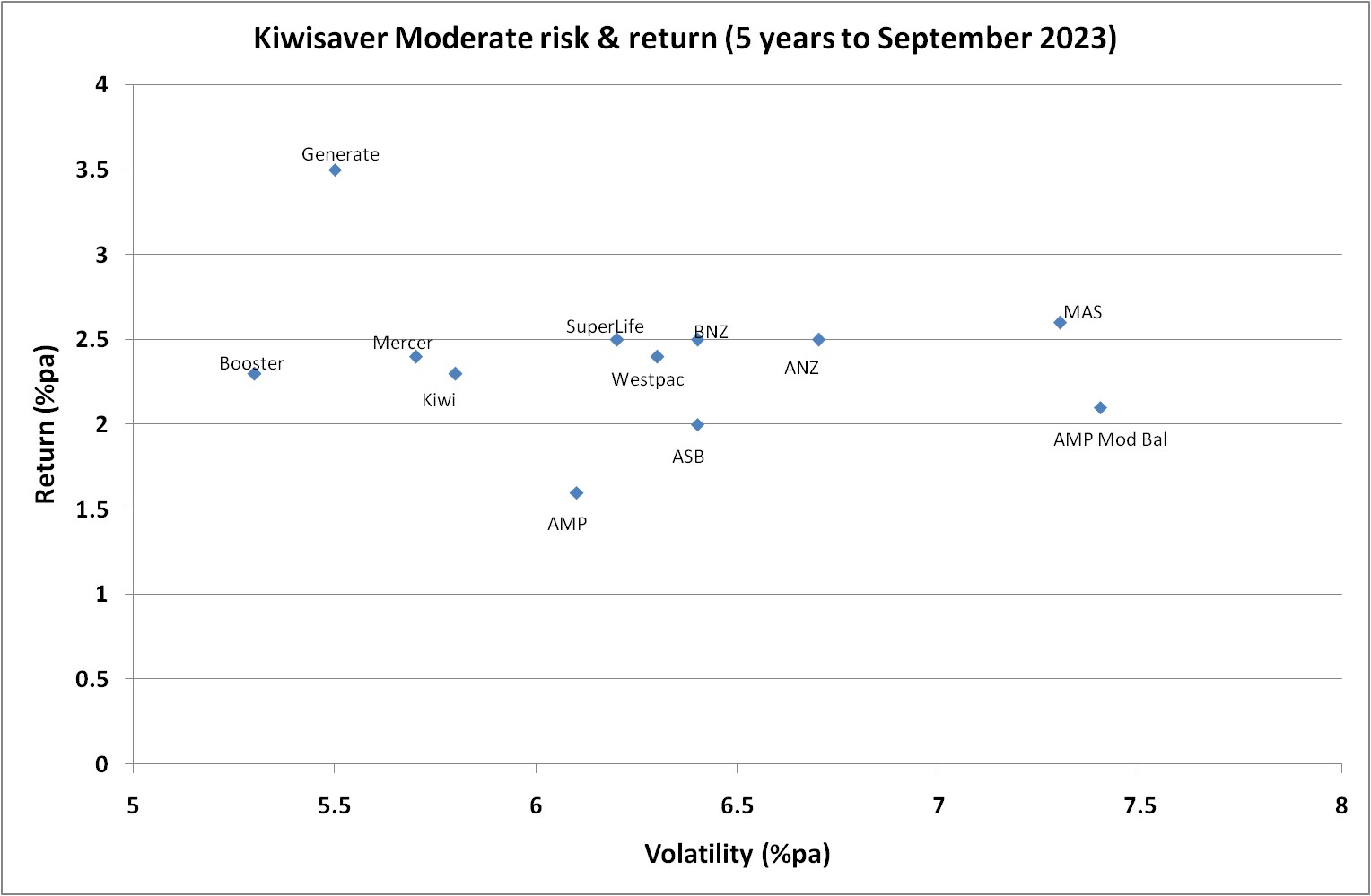

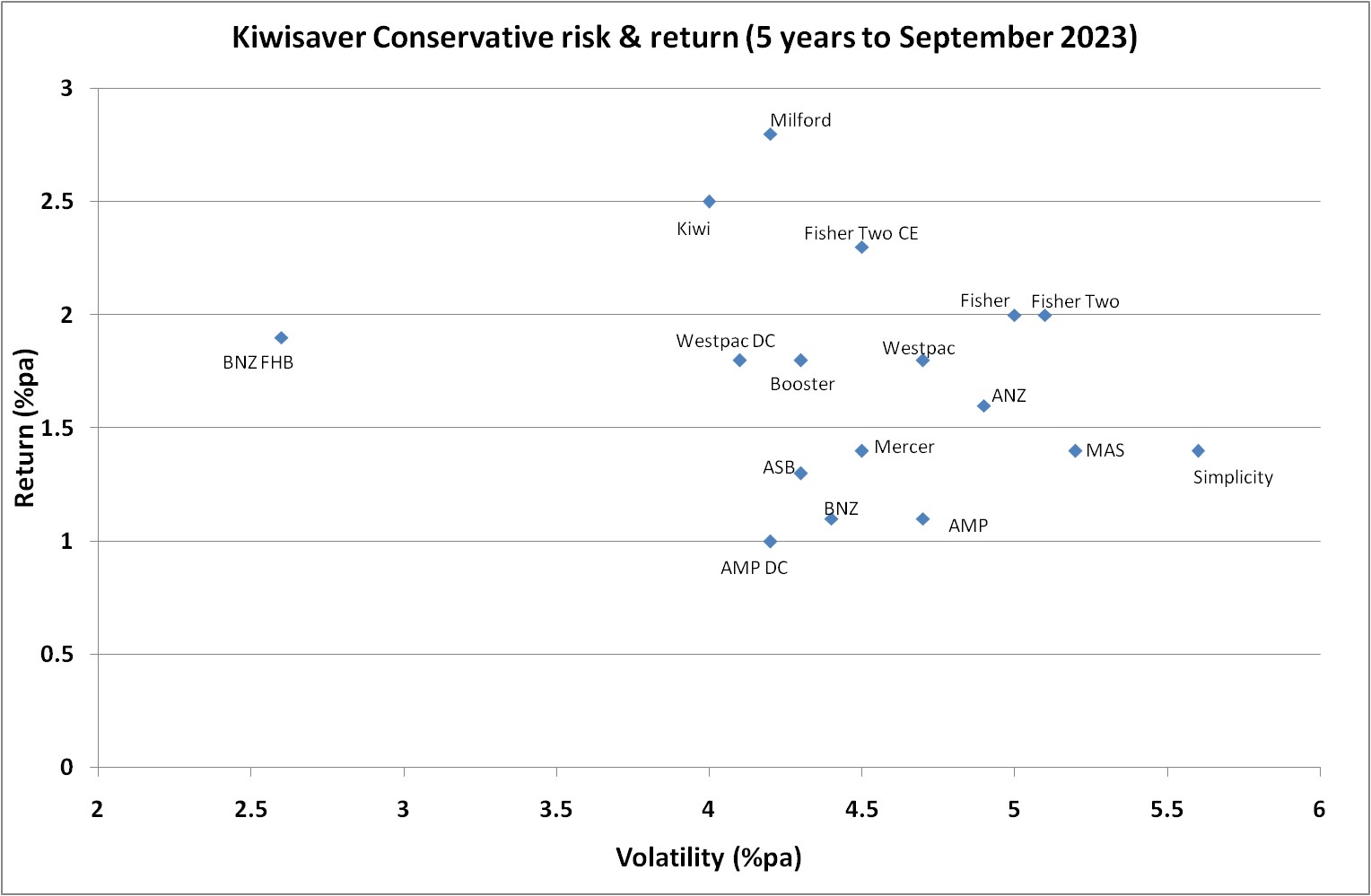

A friendly reminder to take the time to do your annual Kiwisaver review, talk to an advisor (if required) etc etc.

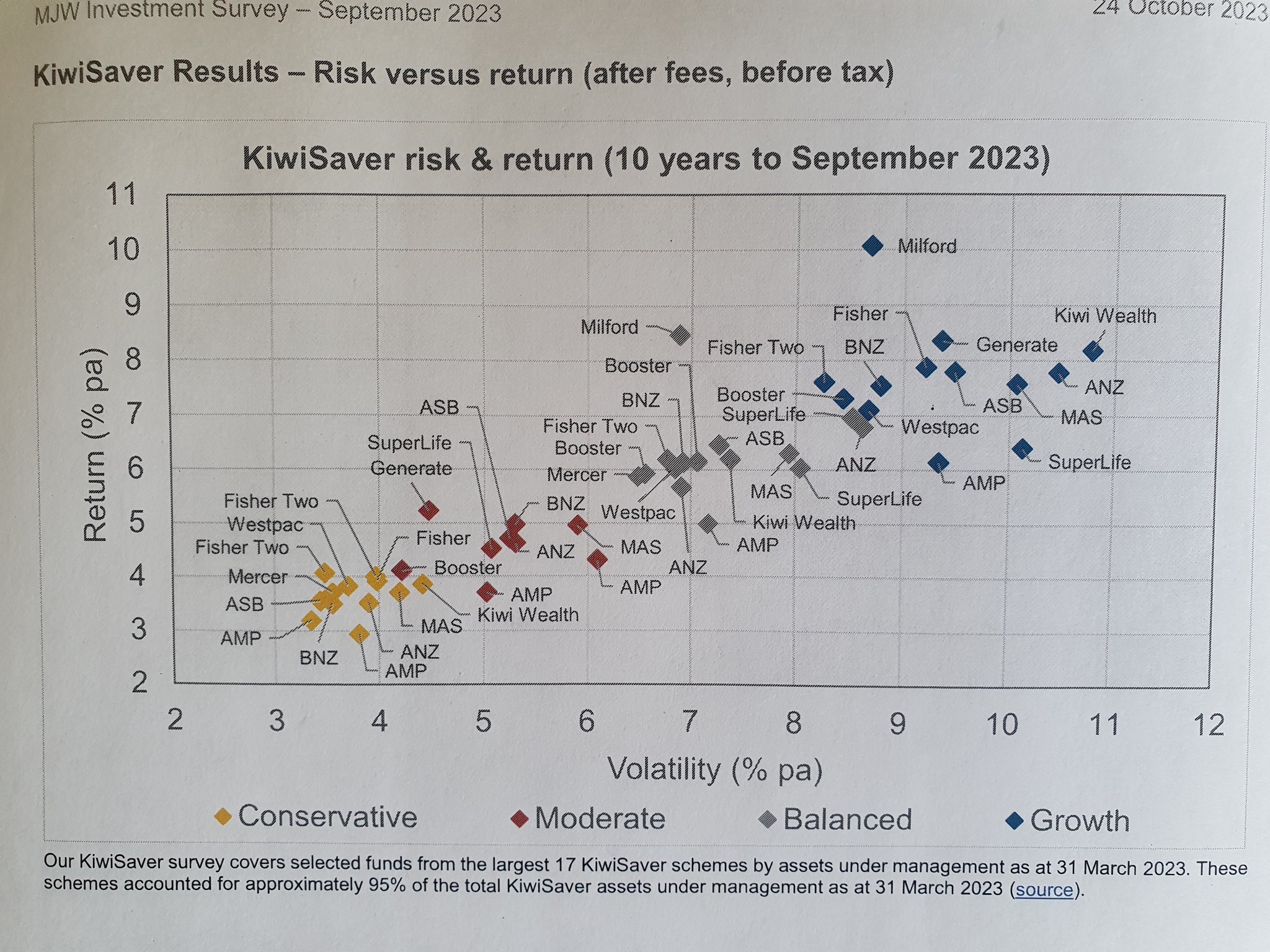

Here is the 10 year return/risk graph from Melville Jessop Weaver covering 85% of Kiwisaver providers. If yours isnt there then ask them why they arent.

Remember the higher the return for the same level of volatility is where you want to be depending on your risk profile. And past returns are not indicative of future performance.

The full report: https://mjw.co.nz/