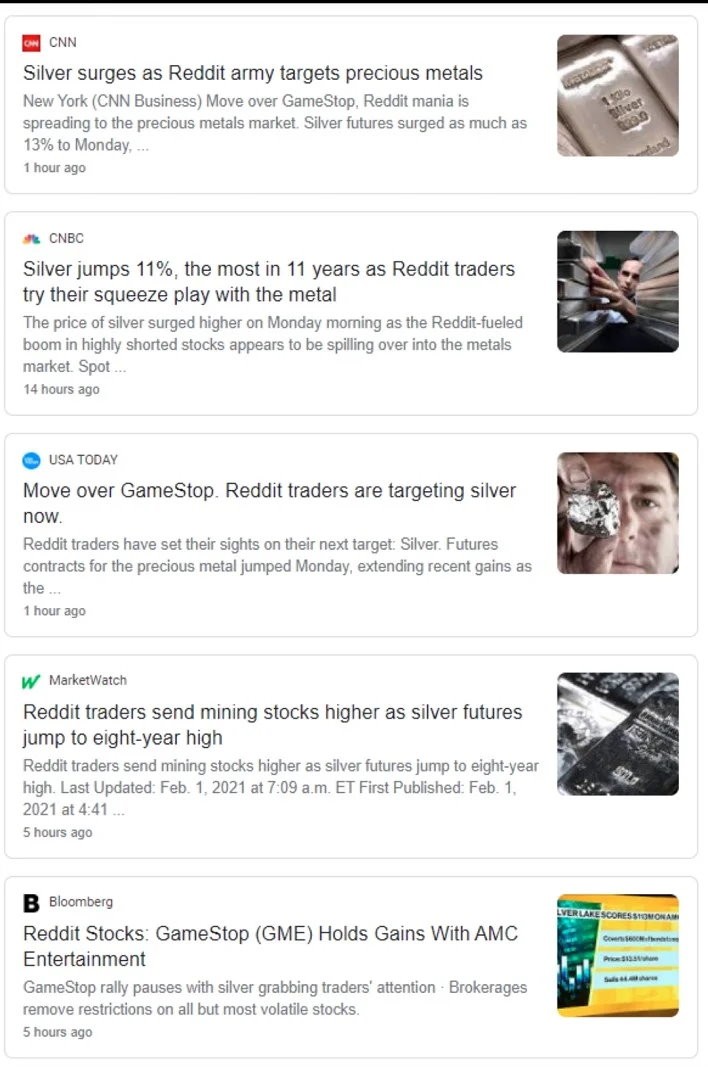

eracode:I have seen several news stories where commentators have reportedly said ‘there’s no reason to believe/no evidence of anything illegal has happened here’.

If “Everythig goes back to how it was (share price under $50)” then a lot of people must have lost a lot of money at that point. Like Dutch tulip bulbs.

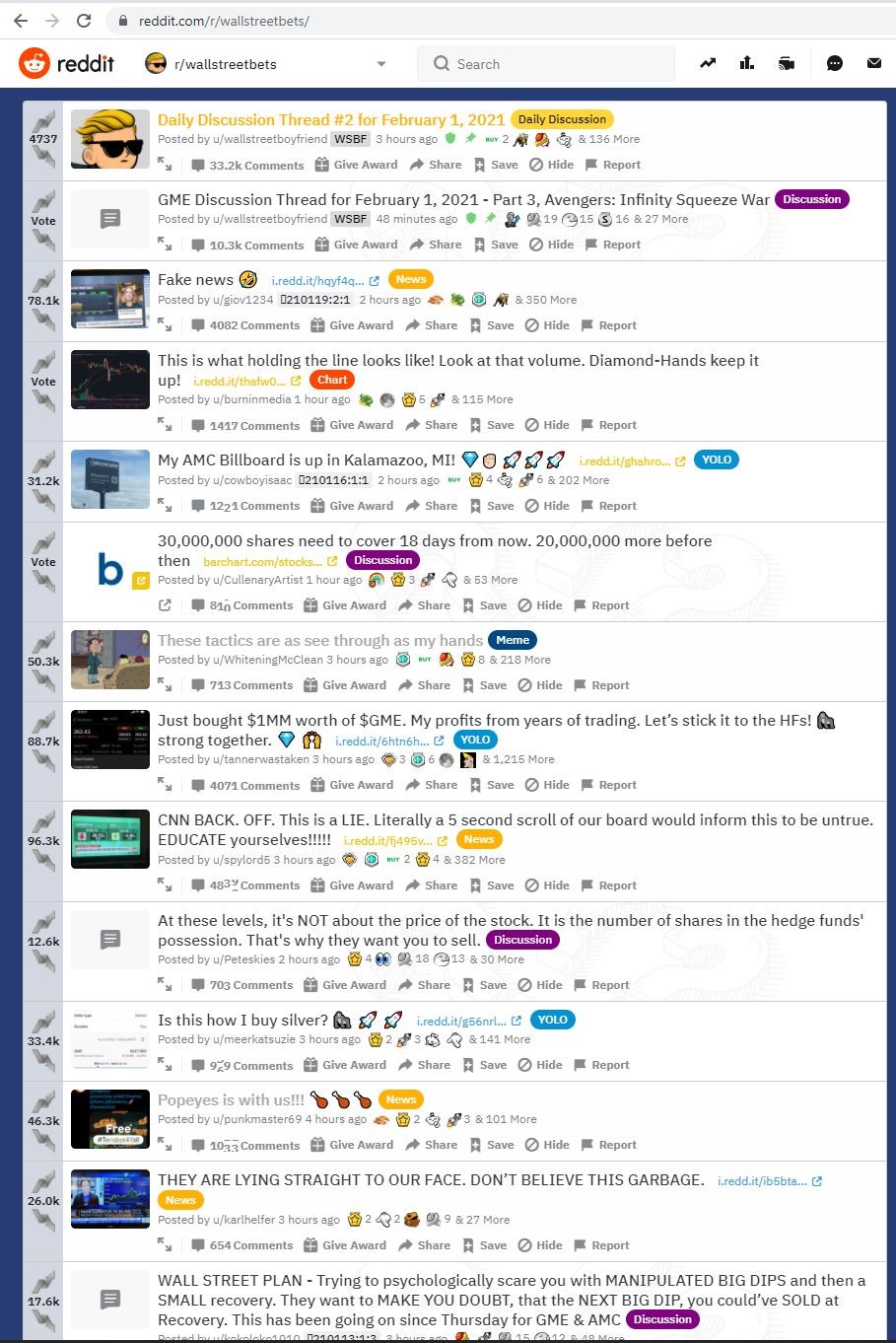

What the mainstream media is struggling to portray is that many of the retail investor's don't care about losing money.

At this point is is crazy to put in more than you are willing to loose. People are either viewing it as a super high risk yolo investment or money spent on activism.

There is a screenshot of one investor with a usd33m gain on a $700k investment. They didn't liquidate at that point. I think it is fair to say that any rational, profit driven retail investor would take their gains at or before that point.