|

|

|

tweake:

omg, stuff just deleted their comment section. i guess people pointing out the obvious was not making the RE gods happy.

I can still see the comments.

Sometimes I just sit and think. Other times I just sit.

eracode:

tweake:

omg, stuff just deleted their comment section. i guess people pointing out the obvious was not making the RE gods happy.

I can still see the comments.

only the handful they left and all glowing positive about how wonderful it is.

Positive house buying stories get drip fed on a regular cycle by the media it seems. Helps stoke the FOMO.

It is less common to see negative ones. But I know several people are around me who have had to sell their houses at considerable lessor amounts than they paid for them. Likely losing any equity and deposit they had. One case was someone that lost their job and had no option but sell and prices have dropped a good 15%-20% since they purchased at the peak.

mattwnz:

These stories get drip fed on a regular cycle by the media it seems. Helps stoke the FOMO.

especially when taken in context with other stories about houses not selling, or only getting offers below what they want, so they sit and wait. of course what industry doesn't make money when people sit and wait.

tweake:

only the handful they left and all glowing positive about how wonderful it is.

Oh, that sounds like just what Stuff did when they launched their "new" "improved" (read: crappy) website earlier this year, until they realised that the feedback was about 95% negative, then the comments mysteriously disappeared too.

On topic, I'll be interested to see what interest rates do over the coming months. I think some people are still quite greedy though - they look at what their neighbour's place sold for 12-18 months ago and expect to get the same thing...not going to happen.

quickymart:

tweake:

only the handful they left and all glowing positive about how wonderful it is.

Oh, that sounds like just what Stuff did when they launched their "new" "improved" (read: crappy) website earlier this year, until they realised that the feedback was about 95% negative, then the comments mysteriously disappeared too.

On topic, I'll be interested to see what interest rates do over the coming months. I think some people are still quite greedy though - they look at what their neighbour's place sold for 12-18 months ago and expect to get the same thing...not going to happen.

worse. they cherry picked "good" comments. it is/was open and got a lot of "good" comments. no idea how many negative comments went in the bin. all the "good" comments are from boomers praising the hard work and sacrifice a gifted student who landed an middle aged adults wage in their first job, and then pretending thats how it is for all young people. so you can all go buy my massively overpriced houses.

so much for unbias reporting in media these days.

in some way i hope they keep the ocr up. the one industry thats not loosing out is the RE industry, funny that. things are not going to slow down until housing slows down. there should be RE layoffs well before inflation eases off. i think we are just starting to see things bite, which is why the banks are dropping rates and RE doing their FOMO campaign. if housing doesn't cool down its simply going to bounce back up and inflation will rebound and then round 2 of ocr increases.

I've noticed that the NZ media doesn't mention the words 'house price crash', yet it is being used overseas to describe NZs housing market https://www.macrobusiness.com.au/2023/05/new-zealands-house-price-crash-is-one-for-the-ages/

Banks are hoping that the reserve bank is going to reduce interest rates later this year to get the market going again and get prices back on the way up. But time will tell.

tweake:

only the handful they left and all glowing positive about how wonderful it is.

You said they had 'deleted their comment section'.

Sometimes I just sit and think. Other times I just sit.

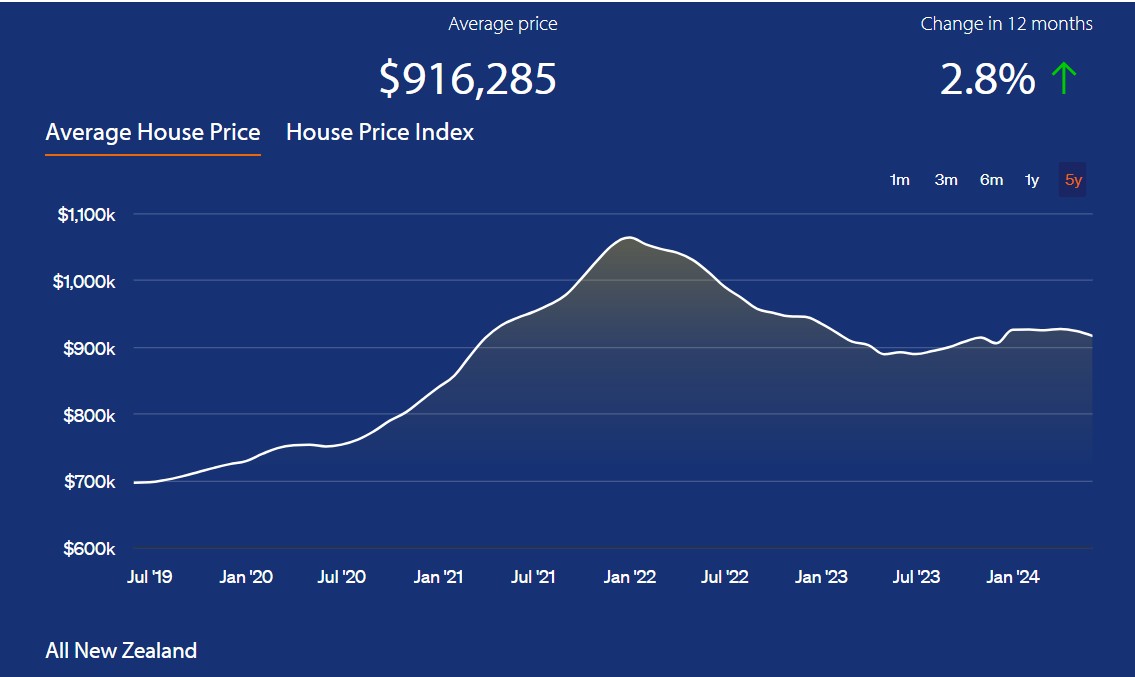

If you replace the COVID bump with a straight line from Jan '21 to Jan '23 it just looks like steady growth.

What it really does show is how the OCR and consequently mortgage rates affect the market. 2% mortgages followed by 7% mortgages caused by the RBNZ created that spike and decline. Mortgage rates are now on their way down so I would not be surprised if that line ticks up accordingly.

eracode:

tweake:

only the handful they left and all glowing positive about how wonderful it is.

You said they had 'deleted their comment section'.

they did, they deleted everyone's. then put in a few good ones and then let people put "good" comments only. same tactic as a bad shop does to reviews.

johno1234:

If you replace the COVID bump with a straight line from Jan '21 to Jan '23 it just looks like steady growth.

exactly. look at the gfc. that was a mere blip. things went straight back to normal with a steady increase.

mattwnz:

I've noticed that the NZ media doesn't mention the words 'house price crash', yet it is being used overseas to describe NZs housing market https://www.macrobusiness.com.au/2023/05/new-zealands-house-price-crash-is-one-for-the-ages/

Banks are hoping that the reserve bank is going to reduce interest rates later this year to get the market going again and get prices back on the way up. But time will tell.

of course nz media doesn't mention it. they don't want to talk a market down, they just want to talk a market up. it just shows how influential the RE market is.

johno1234:

Mortgage rates are now on their way down so I would not be surprised if that line ticks up accordingly.

I wouldn't count on it. A lot more economic pain to come over the next few months. Non-tradeable inflation still high and sticky so RB unlikely to drop OCR much, if at all. Households have used up savings accumulated over the covid period so now starting to seriously struggle, businesses are shutting up shop everywhere, new work is hard to come by for tradies, etc. Meanwhile if you look at the May and June data they show the leading indicators of economic performance were strongly negative after an ok-ish start to the year. A drop in the OCR will take time to filter through to actual spending in the economy.

Anecdotally it's a good time to get a renovation underway if you have the cash. Friends of ours who wanted to do a full reno of a bathroom (after a child-induced flood...) last year couldn't find anyone who would quote anything other than "get lost" pricing, so they didn't go ahead with it. Now it's the opposite, builders are undercutting each other and are all desperate to get the work...

cddt:

I wouldn't count on it. A lot more economic pain to come over the next few months. Non-tradeable inflation still high and sticky so RB unlikely to drop OCR much, if at all. Households have used up savings accumulated over the covid period so now starting to seriously struggle, businesses are shutting up shop everywhere, new work is hard to come by for tradies, etc. Meanwhile if you look at the May and June data they show the leading indicators of economic performance were strongly negative after an ok-ish start to the year. A drop in the OCR will take time to filter through to actual spending in the economy.

Anecdotally it's a good time to get a renovation underway if you have the cash. Friends of ours who wanted to do a full reno of a bathroom (after a child-induced flood...) last year couldn't find anyone who would quote anything other than "get lost" pricing, so they didn't go ahead with it. Now it's the opposite, builders are undercutting each other and are all desperate to get the work...

The non-tradeables is exactly why the OCR should come down. There's little benefit to inflicitng prolonged pain on mortgage holders for longer when it won't move the dial on non-tradeables one bit.

But yes, you're right, and something I'm trying to drum into people at work looking at forecasts; even once the rates start to drop, people still hold out for longer expecting them to go lower. Holding out on re-fixing on mortgage has seen us 'gain' 0.15% on our loan rates in a few weeks.

|

|

|