mattwnz:I've noticed that the NZ media doesn't mention the words 'house price crash', yet it is being used overseas to describe NZs housing market https://www.macrobusiness.com.au/2023/05/new-zealands-house-price-crash-is-one-for-the-ages/

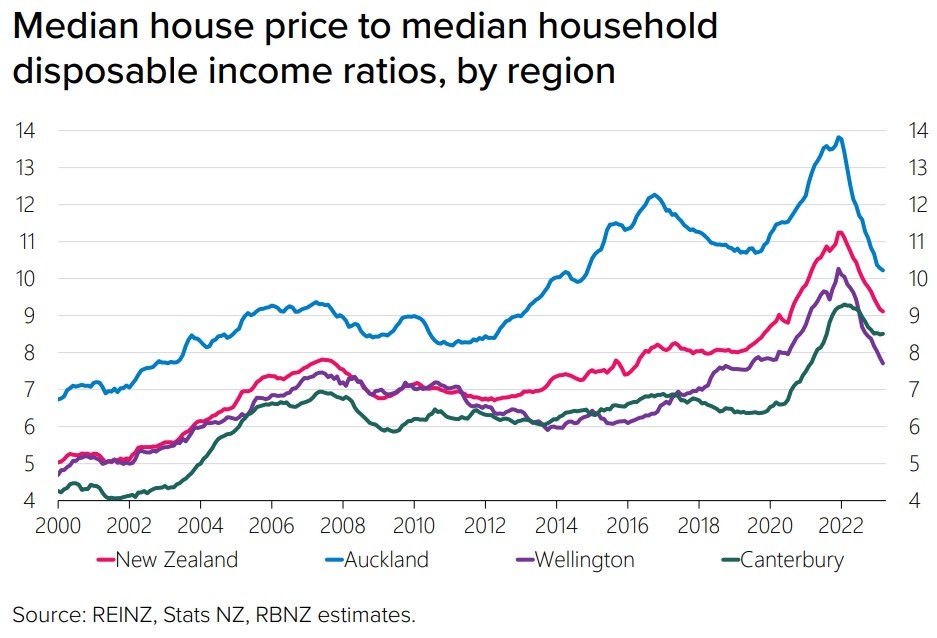

This graph is a horror show. It's no wonder renters believe they'll never get onto the property ladder.

New Zealand ranked as the sixth least affordable country in the world to purchase property.

However, worldwide economists suggest that a reasonable measure for affordable housing is for prices to stay within three times household income.

For example, if you and your partner earn $100,000 combined, the maximum you should borrow as an owner-occupier is $300,000.

According to today's Trademe listing, this is barely within the limits of a South Auckland tiny rural titlehold bach, no garaging, no decking and no landscaping, with a 90 minute commute one-way best-case to Auckland CBD, flood prone, at QV $485,000, asking for $585,000