freemark: Just don't get into the industry anywhere near sales :)

Any industry in fact..imagine telling the guy who wants a new Porsche what he should be doing with his money instead.

But some people just want Solar PV, whatever the equation. Good on them.

Btw I have qualified my model here from the start IMO.

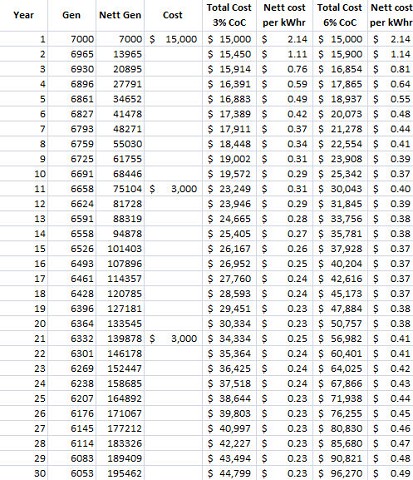

Wow, that's a really good reflection on the sales industry. Tell the customer what they want to hear and disregard anything else? Try running your model using a 3% cost of capital (assuming they have no mortgage). Doesn't look so good now does it? Then look at 6% (if they do have a mortgage) and it makes it terrible. Remembering that this assumes you use 100% of the power before it leaves your premises. Any injection to the grid and at the new rates you are even worse off. I have even used your 0.5% yearly output degradation suggested below.

freemark: And I'm interested in why you don't think 2% per year increase in retail electricity prices is in any way out of order. Some PV crowds use a figure of 3%, and a possibly more accurate .5% annual output drop...

I just think that trying to forecast the price of anything 10 let alone 30 years into the future is impossible. There is a very high chance there will be a step change at some time within the next 30 years of power generation that will make the investment a dead duck (distribution companies like the catchphrase "stranded asset"). But in saying that I do acknowledge it is probably the best thing you can do if you do want to try and analyse full life cycle payback.

Sorry if you are taking my scrutiny as a personal attack, it is not intended. Coming from a scientific background I am looking at it in a rather black and white way and I know not everyone thinks like that. But from a purely numbers perspective I just can't see how you can disregard the cost of capital when you are I just don't agree with the way you are analysing the investment decision.