|

|

|

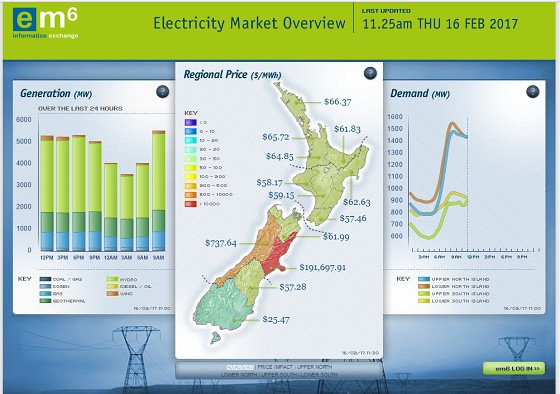

That Christchurch spike went from $62.29 to $480,049.00 in 5 mins. My Flick dashboard shows a jump from 16.28c to 17.84c for the half hour fortunately! Although presumably there's still some settlement processing to do before it's finalised

robertsona:

I'll see you, and raise you Christchurch this last Monday morning:

I find the PRS prices more helpful than RTPs in these situations. The PRS price shows the prices expected to prevail for the half-hour. I also track RTPs but become concerned only if RTPs become much higher than the PRS price during a trading period and continue to be so into the next one as final prices are derived using conditions at the beginning of the trading period.

Currently $194,646.07 MWh in Canterbury and been sitting there for a while. Of course Flick's App/Portal are down.

I can access the flick portal.

Yeah this is the new largest I've seen...

Michael Murphy | https://murfy.nz

Referral Links: Quic Broadband (use R122101E7CV7Q for free setup)

Are you happy with what you get from Geekzone? Please consider supporting us by subscribing.

Opinions are my own and not the views of my employer.

timmmay:

I can access the flick portal.

Was able to access again a few minutes after I posted (although it wouldn't give a current price). Was out via both mobile and fixed (different networks). Thankfully looks like the spike was short and has settled again.

luckiestmanalive:

I find the PRS prices more helpful than RTPs in these situations. The PRS price shows the prices expected to prevail for the half-hour. I also track RTPs but become concerned only if RTPs become much higher than the PRS price during a trading period and continue to be so into the next one as final prices are derived using conditions at the beginning of the trading period.

Sort of.

PRS (and NRS) are different schedules produced on a half hour basis for the entire half hour. These have a number of assumptions inside them (for example most traders do not trade to the PRS because there is some market behaviour from difference bids which are accounted for but never observed).

RTP & RTD are real time "indicative prices" and are 5 minute solves. If there is a single 5 minute spike in a half hour period it will likely wash out, but if its a sustained elevation above NRS then it will likely stick.

RTP & RTD are good for seeing short term stuff but you should never rely on them solving through to the provisional, interim or final pricing runs.

As for the Waikato thing, I believe there was a constraint on HAM_KPO (both circuits) which caused a spring washer around the grid zone.

Prices crashed overnight on the back of the following;

During the day as load picks up you'll see a bit more stability in price.

Interesting. I was mostly asking why EM6 is showing a big peak but Flick is showing things pretty level.

timmmay:

Interesting. I was mostly asking why EM6 is showing a big peak but Flick is showing things pretty level.

I believe the NRSS schedule was pretty flat for most of the night, whilst the RTP / RTD prices were a bit up and down (as a result of the thin stack).

I've just changed over to Flick (I'm in Canterbury). Can anyone tell me how often I can expect price spikes? Do these generally happen at a certain time of day? Is it likely that they could happen overnight when things like hot water, heat pump, or perhaps an EV are charging?

|

|

|