Just received:

The Commerce Commission has identified several factors it considers are affecting competition in New Zealand’s retail fuel market, which may mean consumers are currently paying higher pump prices for petrol and diesel than could be expected in a competitive market.

In December 2018, the Government asked the Commission to undertake a market study into the factors affecting competition for the supply of retail petrol and diesel used for land transport in New Zealand.

The Commission’s draft findings released today are preliminary and subject to consultation, with its final report due to be published in early December.

“Fuel purchased at service stations and truck stops accounts for about 98% of the petrol and 73% of the diesel consumed in New Zealand, at an annual cost of more than $10 billion. For many families and businesses fuel is a significant weekly expense and there has been public concern for some time that pump prices may be higher than they should be,” Commission Chair Anna Rawlings said.

“Our current view is that the fuel market is not as competitive as it could be.”

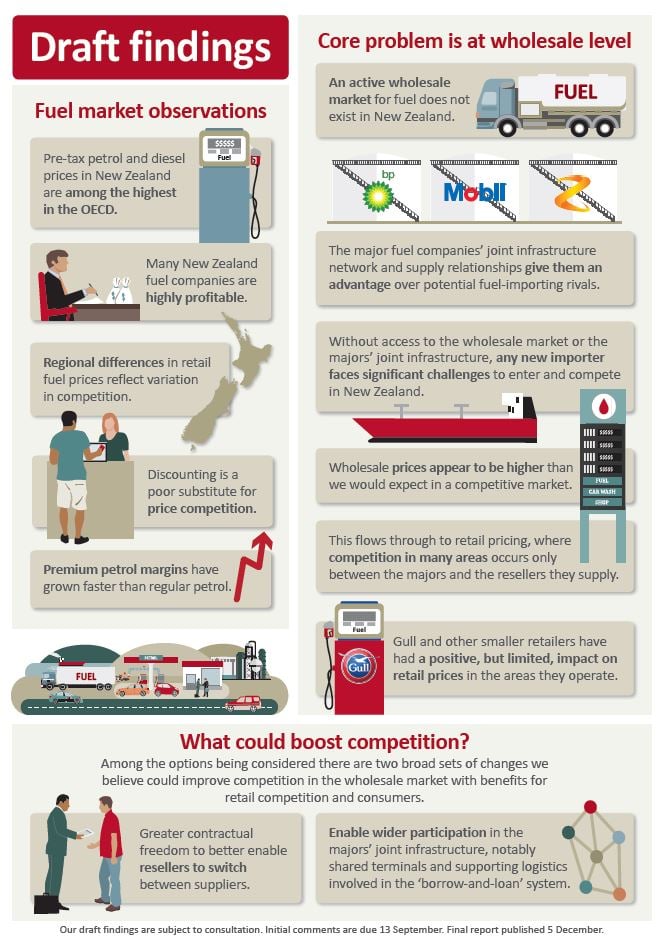

Our reasons for this include:

- Many fuel companies are highly profitable

- Regional differences in retail fuel prices reflect variations in competition levels

- Discounting does not provide a substitute for competition on board prices

- Premium petrol margins have grown faster than regular petrol.

“Our preliminary findings suggest that many fuel companies are earning returns on investment that are higher than what we would consider a reasonable return to be. In our view, the problem is the lack of an active wholesale market in New Zealand.”

Z Energy, BP and Mobil (the majors) currently have a series of infrastructure sharing arrangements that date back to before the fuel market was deregulated in 1988. This includes allocated use of the Marsden oil refinery, a fuel pipeline to Auckland and a coastal shipping operation, with supporting logistics, which transports refined fuel to a network of storage terminals at regional ports.

These same firms use this joint network to supply 90% of the nation’s petrol and diesel, either through their own branded service stations or via other distributors or resellers on exclusive long-term wholesale supply contracts.

Without access to the majors’ shared network or the wholesale market, any new importer faces the challenge of establishing its own stand-alone supply chain, at considerable expense. The alternative is to convince existing distributors to switch from a major to their supply.

“The majors’ joint network gives them a significant advantage over any other potential rival importers, as their costs to deliver fuel are lower. They also have long-term supply relationships with their resellers, most of whom have only ever had the same supplier, which has made it very difficult for competitors to enter or compete more vigorously in the market,” Ms Rawlings said.

“Not only have other fuel importers been unable to access the wholesale market, but the majors themselves have limited incentive to compete with each other during the terms of their supply contracts. As a result, competitive pressure does not appear to be driving down wholesale prices in New Zealand.

“This then flows through to retail pricing where competition is inconsistent and often constrained by the wholesale price resellers pay the majors that supply them. While Gull has had a positive impact in reducing prices for consumers in areas it operates, it is also incentivised to maximise its own profits and can do so with little threat of further competition driving prices down.”

The Commission has outlined some options it considers could improve competition. There are two broad sets of options it thinks may have the potential to help create a competitive wholesale market. These are:

- Greater contractual freedom to make it easier for resellers to switch between suppliers; and

- Enabling wider participation in the majors’ joint infrastructure, notably the shared terminals and supporting logistics involved in their borrow-and-loan system.

Further options, including improving the transparency of premium petrol prices, are discussed in the draft report.

“The options we are considering in the wholesale market are not quick fixes, but may help to open up the market and improve competition over time. We particularly want to test their feasibility with fuel companies and other experts, and gauge whether there may be other options that could help competition,” Ms Rawlings said.

The draft report reflects the Commission’s current thinking and analysis. It will now test its findings and the options under consideration through public submissions and a conference.

Comments on the draft report are due by Friday 13 September. The conference will be held in central Wellington from 24 to 27 September, with only the first day likely to be a public session that will be open to the media (subject to space). Post-conference comments are to be received by 11 October.