From Commerce Commission:

A new regulatory regime designed to enhance competition in New Zealand’s fuel markets comes into effect tomorrow (11 August 2021).

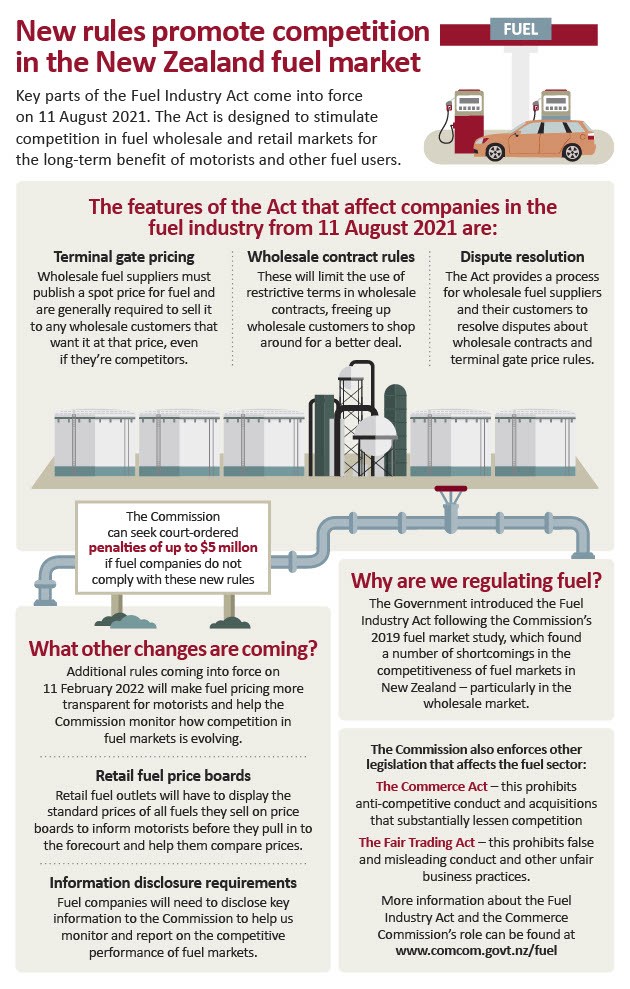

The Commerce Commission has a monitoring and enforcement role under the Fuel Industry Act 2020, key parts of which are intended to stimulate competition at the wholesale level of the market.

Commission staff have been meeting in recent weeks with businesses in the fuel sector to help them understand their obligations and rights under the new rules before the regime goes live.

The features of the Act that will affect businesses in the fuel industry from tomorrow are:

Terminal gate pricing – Wholesale fuel suppliers must publish a spot price for their fuel at storage terminals and are generally required to sell fuel to any wholesale customers that want it at that price, even if they’re competitors.

Wholesale contract rules – These will limit the use of restrictive terms in wholesale contracts, freeing up wholesale customers like distributors and petrol stations to shop around for the best deal to meet their needs.

Dispute resolution – The Act provides a process for wholesale fuel suppliers and their wholesale customers to resolve disputes about wholesale contracts and terminal gate price rules.

Under additional rules that are scheduled to take effect from February 2022, petrol stations will have to display the standard prices of all fuels they sell on price boards. Fuel businesses will also need to disclose key information to the Commission to help it monitor and report how competition in fuel markets is evolving.

The Commission can seek court-imposed penalties of up to $5 million if fuel businesses do not comply with these new rules.

The Government introduced the Fuel Industry Act following the Commission’s 2019 fuel market study, which found a number of shortcomings in the competitiveness of fuel markets in New Zealand.