Hi everyone. I took my first car insurance policy about 6 months ago. I went with AA, the mid-tier option: "Third Party, Fire & Theft".

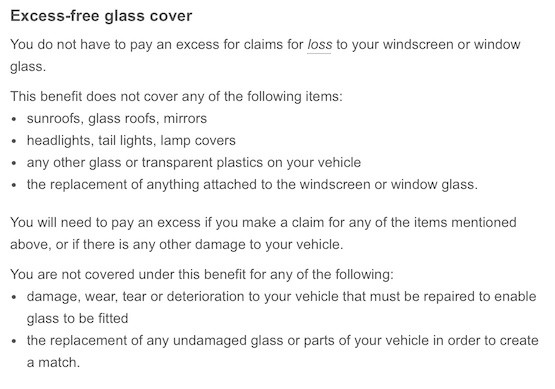

There was an option for excess-free glass cover that I did not choose. The wording made me think that this option was for not having to pay excess on glass repairs.

My windscreen cracked this week, and now AA is saying that without that option, I have no glass cover at all, zero.

People with AA insurance, does this sound right to you?

Thanks!