|

|

|

dt:we are behind the times here in NZ. mates bank in Aussie lets him setup virtual cards linked to his physical on demand. i'm yet to find a bank that offers that here..

In the US it's motivated by the staggering amounts of fraud and neverending leaks and breaches of CC details. Every single time I've had my card replaced it's been due to breaches in the US. Also with the US' stuck-in-the-1950s payment systems you end up using your credit card for everything (unless you're still using cheques everywhere), so there's a much bigger attack surface. NZ has had EFTPOS and direct bank-to-bank payments more or less forever so there's probably little incentive for banks to do it here. Another example of this is the non-presence of Paypal in NZ, there's never been any need for them unlike the US.

So many people over there don't get why we have no use for venmo or the others like it here.

Its funny to see people trying to start up the same idea here with dosh, and not being able to explain how it gets me the cash any faster than the other person paying me. I get if they had accounts with all banks and could send it straight to my account, or had a card I could use at an ATM, but its neither, they consider the money in the dosh account to me being paid, so therefore its faster than bank transfer.

Till the US stops allowing cards to be processed thru point of sale machines at the large retailers then they will keep with the fraud. Its annoying they go PCI compliance overboard for online and let those abortions of in person systems remain. They all cry that they would have to upgrade their fuel pumps etc to cope with chips when thats a cost the rest of the world has dealt with many times over as PCI evolved.

richms:Till the US stops allowing cards to be processed thru point of sale machines at the large retailers then they will keep with the fraud.

I doubt that'll ever happen. All the US banks colluded to block chips in credit cards for years so they wouldn't have to upgrade their insecure mag-stripe-based infrastructure (nothing like a common threat to unite erstwhile enemies), and the huge push to debit cards is also driven by the US banks so they can sidestep RegE and RegZ consumer protection laws, which don't apply to debit cards. Our banks may be [long string of unprintable material] but at least they make some effort to keep their customers safe.

neb:

I doubt that'll ever happen. All the US banks colluded to block chips in credit cards for years so they wouldn't have to upgrade their insecure mag-stripe-based infrastructure (nothing like a common threat to unite erstwhile enemies), and the huge push to debit cards is also driven by the US banks so they can sidestep RegE and RegZ consumer protection laws, which don't apply to debit cards. Our banks may be [long string of unprintable material] but at least they make some effort to keep their customers safe.

They've been pushing Chip and Signature (unfortunately not PIN) for years, I've got several US-issued chip cards (Amex, Visa and Mastercard)

Kyanar:

They've been pushing Chip and Signature (unfortunately not PIN) for years, I've got several US-issued chip cards (Amex, Visa and Mastercard)

Yeah but they still have fuel pumps and restaurants that use the mag stripe and no authentication at all.

They will store card numbers and process at a later time so its quite common for a stolen card that is reported missing to be able to be used at retailers there for small things because they don't even authorize for below a set amount.

and the zip code at the fuel pump thing makes using a foreign card there impossible. Makes a mockery of the old loaded card saying "accepted everywhere visa is" in their ads.

Kyanar:They've been pushing Chip and Signature (unfortunately not PIN) for years, I've got several US-issued chip cards (Amex, Visa and Mastercard)

Yeah, they eventually caved when they couldn't delay any longer, but as you point out it was just another level of delay since it's Chip and Nothing [*], and mag stripes are still widely utilised. Combine that with their crazy way of handling cards where waitstaff take your card away and disappear out the back with it for awhile for which Chip and Nothing makes skimming even easier than it was before and you can see why fraud is rampant over there.

[*] Must try one of my US cards here to see what happens, i.e. whether (a) it asks for a PIN and (b) it can handle one when entered.

OP - I am confused.

Are you looking for a Virtual Card (i.e. 16 digits, CVV and expiry date, but no physical plastic), or a "virtual" or tokenised card in a wallet - i.e. Apple Pay, Google Pay etc?

If you're looking for a Virtual Card, what are you looking to do with it? Is it one-off use, multi-use, personal or business?

Do you need to issue a Virtual Card instantly, to pay for certain things, or are you looking to get a "virtual card" that is for longer-term use?

Handsome Dan Has Spoken.

Handsome Dan needs to stop adding three dots to every sentence...

Handsome Dan does not currently have a side hustle as the mascot for Yale

*Gladly accepting donations...

Handsomedan:OP - I am confused.

Are you looking for a Virtual Card (i.e. 16 digits, CVV and expiry date, but no physical plastic), or a "virtual" or tokenised card in a wallet - i.e. Apple Pay, Google Pay etc?

If you're looking for a Virtual Card, what are you looking to do with it? Is it one-off use, multi-use, personal or business?

Do you need to issue a Virtual Card instantly, to pay for certain things, or are you looking to get a "virtual card" that is for longer-term use?

kingdragonfly:Handsomedan:

OP - I am confused.

Are you looking for a Virtual Card (i.e. 16 digits, CVV and expiry date, but no physical plastic), or a "virtual" or tokenised card in a wallet - i.e. Apple Pay, Google Pay etc?

If you're looking for a Virtual Card, what are you looking to do with it? Is it one-off use, multi-use, personal or business?

Do you need to issue a Virtual Card instantly, to pay for certain things, or are you looking to get a "virtual card" that is for longer-term use?

I'm looking a one-off credit card number. Something that only works for one purchase, for a specific amount, and then is refused for any future attempt.

As mentioned, three large banks in the US offer this service.

It's for an on-line membership. They offer a one-month subscription, but I'm always wary of automatic renewals.

I'm also getting concerned about how many companies have my credit card information, though I use PayPal when possible.

This is an interesting idea. I often use burner email addresses from the likes of InstAddr, never thought of burner credit cards. The two would go hand in hand when dealing with unknown web entities.

neb:

Yeah, they eventually caved when they couldn't delay any longer, but as you point out it was just another level of delay since it's Chip and Nothing [*], and mag stripes are still widely utilised. Combine that with their crazy way of handling cards where waitstaff take your card away and disappear out the back with it for awhile for which Chip and Nothing makes skimming even easier than it was before and you can see why fraud is rampant over there. [*] Must try one of my US cards here to see what happens, i.e. whether (a) it asks for a PIN and (b) it can handle one when entered.

My US cards have a PIN (needed for ATM usage of course) but to be honest I've always used contactless so never really tested whether they would prompt for that PIN when used with a terminal. I have experienced that my Australian cards when used in the US most of the time prompt for PIN, but at some retailers their terminal doesn't support it and would prompt for signature instead.

kingdragonfly:Handsomedan:

OP - I am confused.

Are you looking for a Virtual Card (i.e. 16 digits, CVV and expiry date, but no physical plastic), or a "virtual" or tokenised card in a wallet - i.e. Apple Pay, Google Pay etc?

If you're looking for a Virtual Card, what are you looking to do with it? Is it one-off use, multi-use, personal or business?

Do you need to issue a Virtual Card instantly, to pay for certain things, or are you looking to get a "virtual card" that is for longer-term use?

I'm looking a one-off credit card number. Something that only works for one purchase, for a specific amount, and then is refused for any future attempt.

As mentioned, three large banks in the US offer this service.

It's for an on-line membership. They offer a one-month subscription, but I'm always wary of automatic renewals.

I'm also getting concerned about how many companies have my credit card information, though I use PayPal when possible.

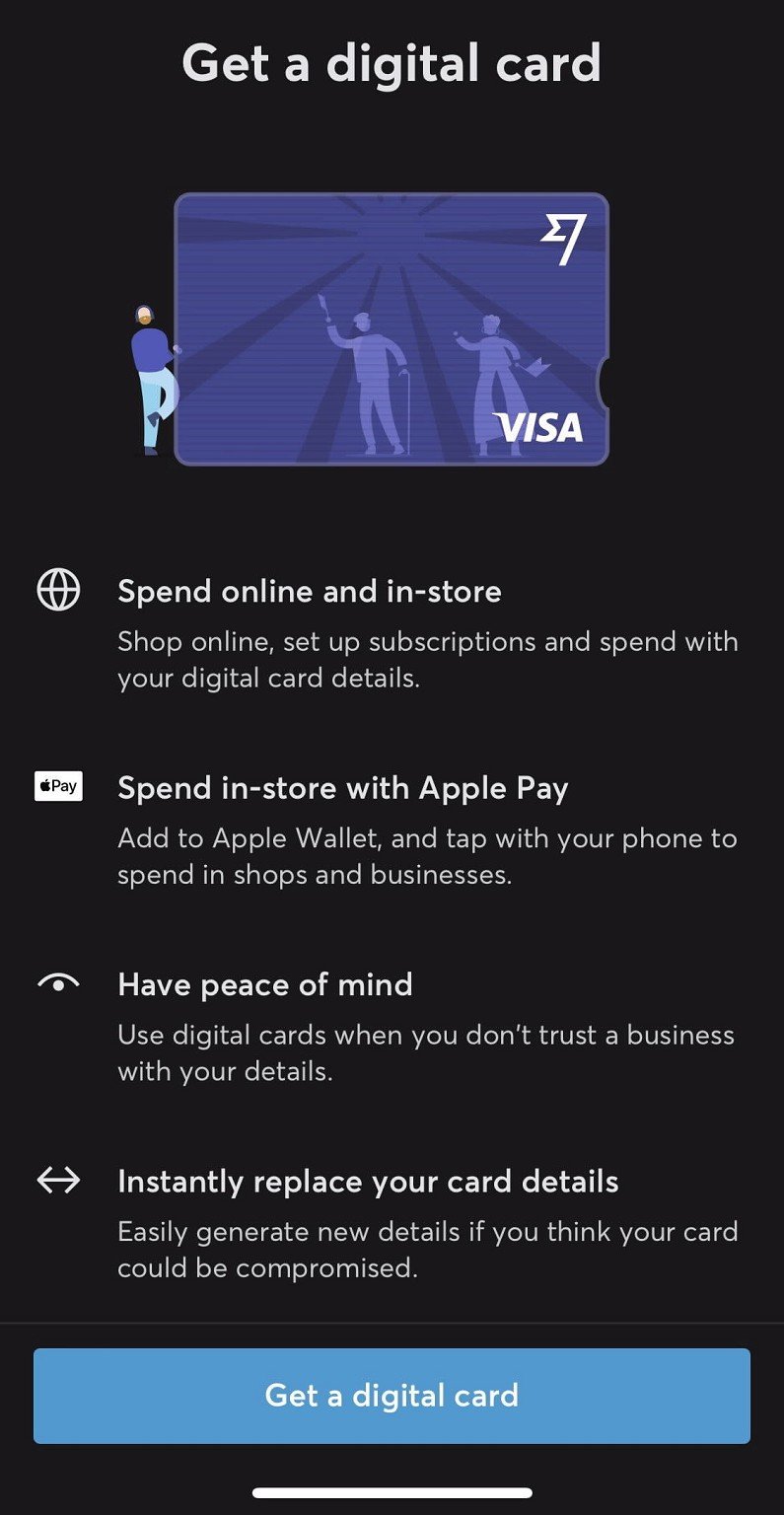

OK - looks like Wise might be the way to go for this then.

It's about the only true VC solution for consumers in the NZ market that I am aware of.

here's a screenshot from the app when trying to create a digital (Virtual) card:

Handsome Dan Has Spoken.

Handsome Dan needs to stop adding three dots to every sentence...

Handsome Dan does not currently have a side hustle as the mascot for Yale

*Gladly accepting donations...

neb:Kyanar:Yeah, they eventually caved when they couldn't delay any longer, but as you point out it was just another level of delay since it's Chip and Nothing [*], and mag stripes are still widely utilised. Combine that with their crazy way of handling cards where waitstaff take your card away and disappear out the back with it for awhile for which Chip and Nothing makes skimming even easier than it was before and you can see why fraud is rampant over there. [*] Must try one of my US cards here to see what happens, i.e. whether (a) it asks for a PIN and (b) it can handle one when entered.

They've been pushing Chip and Signature (unfortunately not PIN) for years, I've got several US-issued chip cards (Amex, Visa and Mastercard)

We have some customers who use them when the exchange rate is bad like at the moment, and they still ask for a pin but they are able to just press enter and have it ask to verify the signature. Our stupid new pin pad asks if the signature is ok on the customer side of it as well which they all just seem to press yes on without even signing things.

Apparently cant disable that as accepting visa means accepting all visa. not sure how PB got away with denying overseas cards but we were told not able to under the merchant agreement. Have to take them all and treat them the same as far as any surcharges that we add in the future.

|

|

|