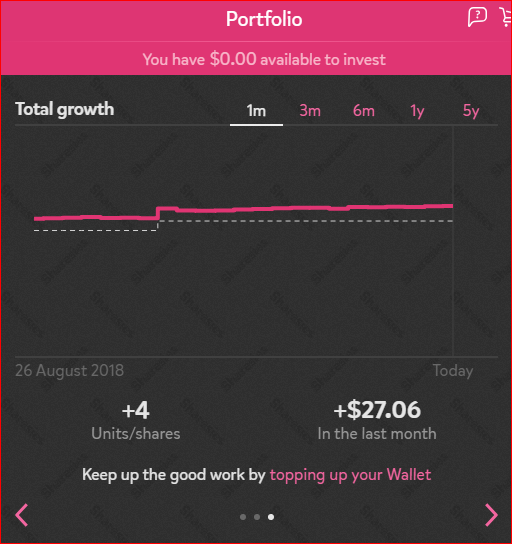

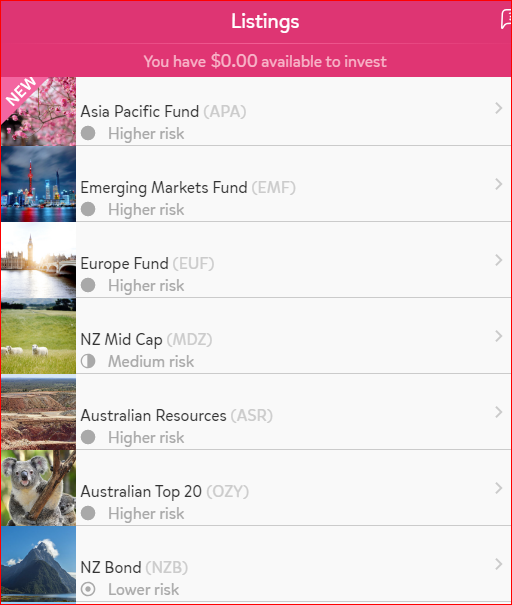

I have some term deposits maturing next month and would like to give investing in shares a try as the current rates with banks are not good (my current TD is at 5.5%). I have around 20-30K to play with. This will be my first time with shares apart from Kiwi Saver. I started reading about a few start-ups e.g Sharesies but am still having trouble deciding which is the best to go with. I read that Sharesies is targeted for investors with 5K or less. I was hoping for some comparison tables e.g. investment amount / term / total amount less fees. I think I can lock it for between 3-5 years.