I'm getting fed up with the continual decline in customer service of our current bank. We're considering changing and cutting all ties with them.

We still have a (revolving credit) mortgage account with that bank, it has a positive balance (so we don't owe them any money but the bank still holds title over the property). To completely disengage we need to discharge the mortgage.

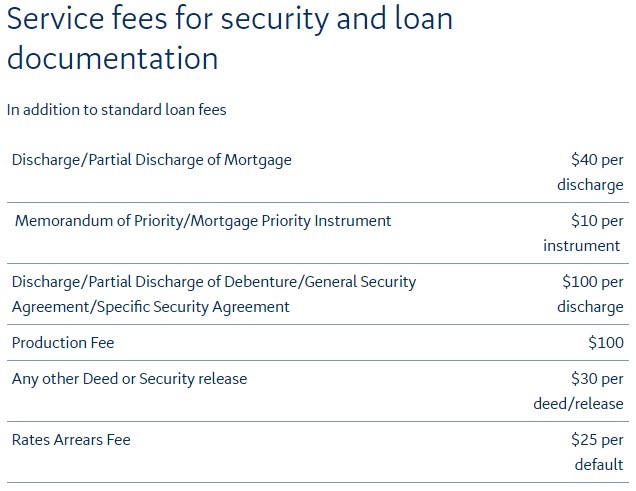

Please can anyone offer some guidance how to go about this. E.g. start with the lawyer or start with the bank. Any any idea of the costs involved. I guess a lawyer will want to be paid for their services, and banks being banks I expect they'll probably charge for this as well

#

#