Melville Jessop Weaver Investment Survey for the December quarter has been released.

A link for any interested https://mjw.co.nz/wp-content/uploads/2024/01/MJW-Investment-Survey-Dec-2023.pdf

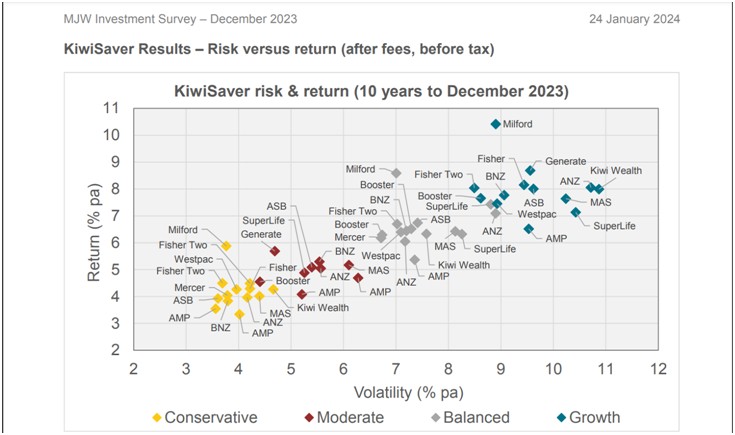

And the Risk/Return graph for the 10 year period for judging your manager against all others in your appropriate risk class. If there is a demand for the 5 yr graphs I'll post them.