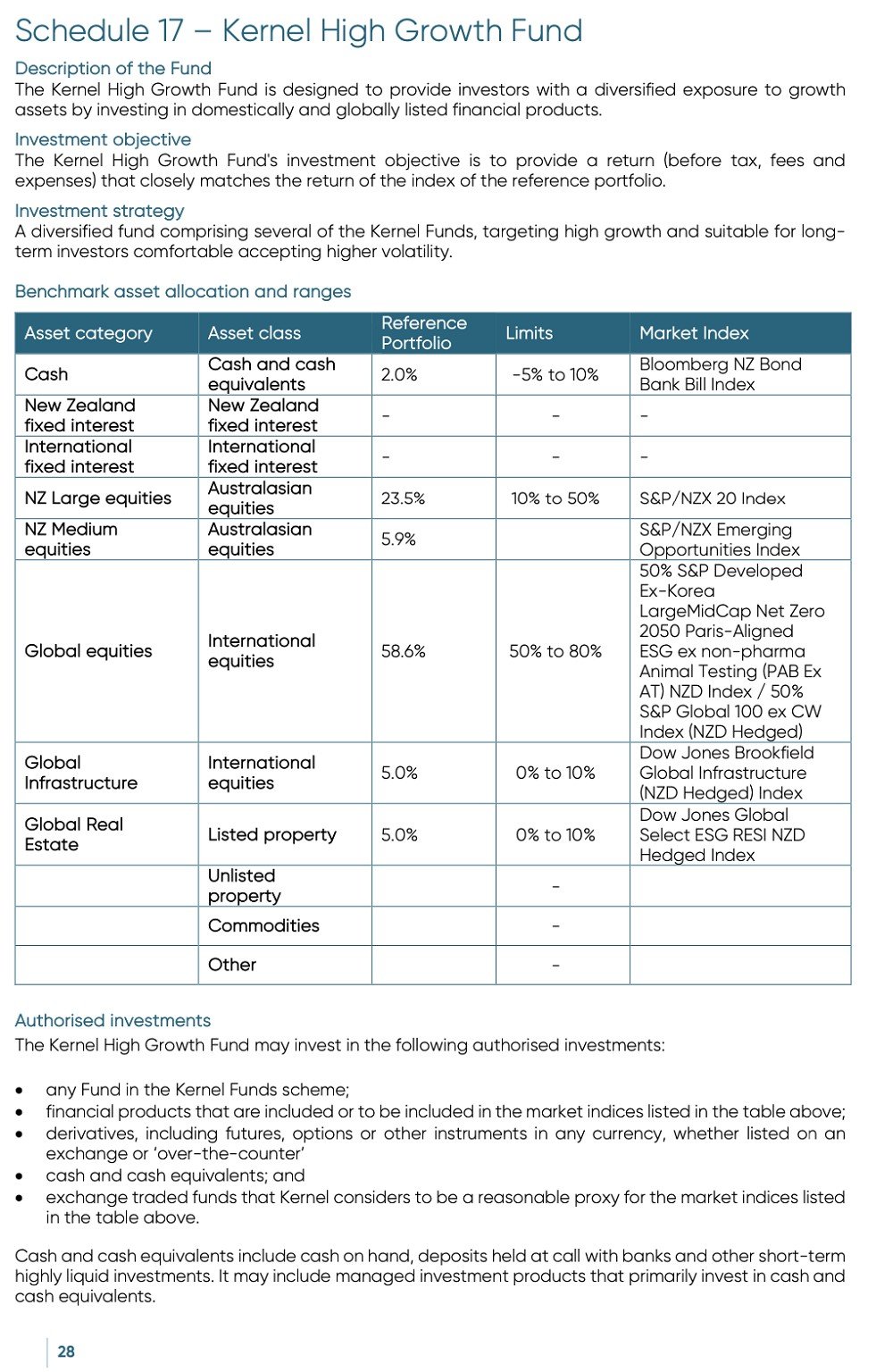

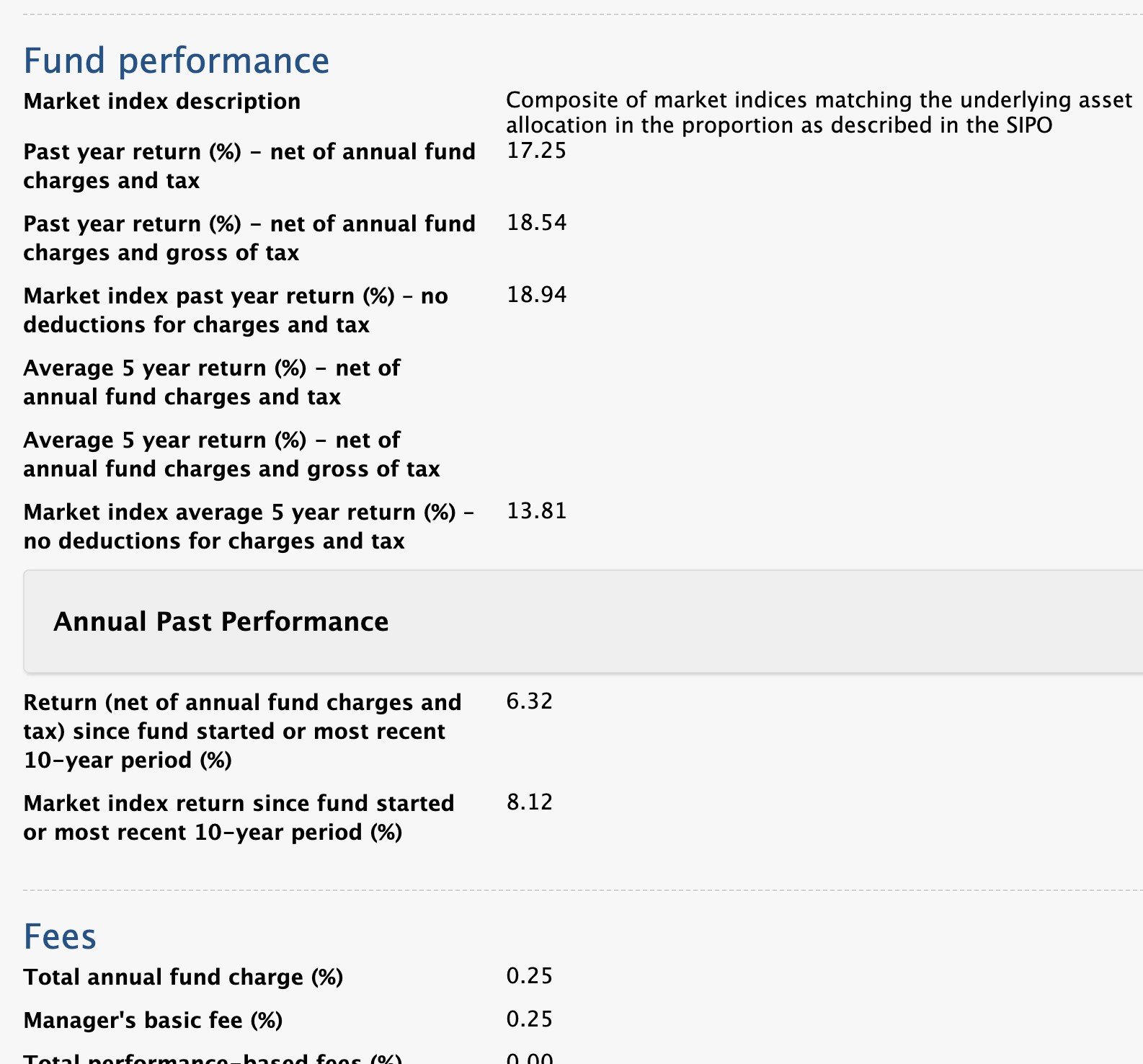

I like there fund options, the S&P500 and Global 100 or there High Growth fund all have pretty great returns.

Even when compared to say Milford (which I think is probably one of NZs best providers for balanced/growth fund return)

Obv past results don't guarantee future returns, but they seem to have some promising options, with low fee's. (similar to Simplicity, another index Kiwisaver, but Kernel, so far, has better returns)

Anyone been with them for a few months/year? What has your experience been like?