Melville Jessop Weaver Investment Survey for the March quarter has been released.

A link for any interested https://mjw.co.nz/wp-content/uploads/2024/05/MJW-Investment-Survey-Mar-2024.pdf

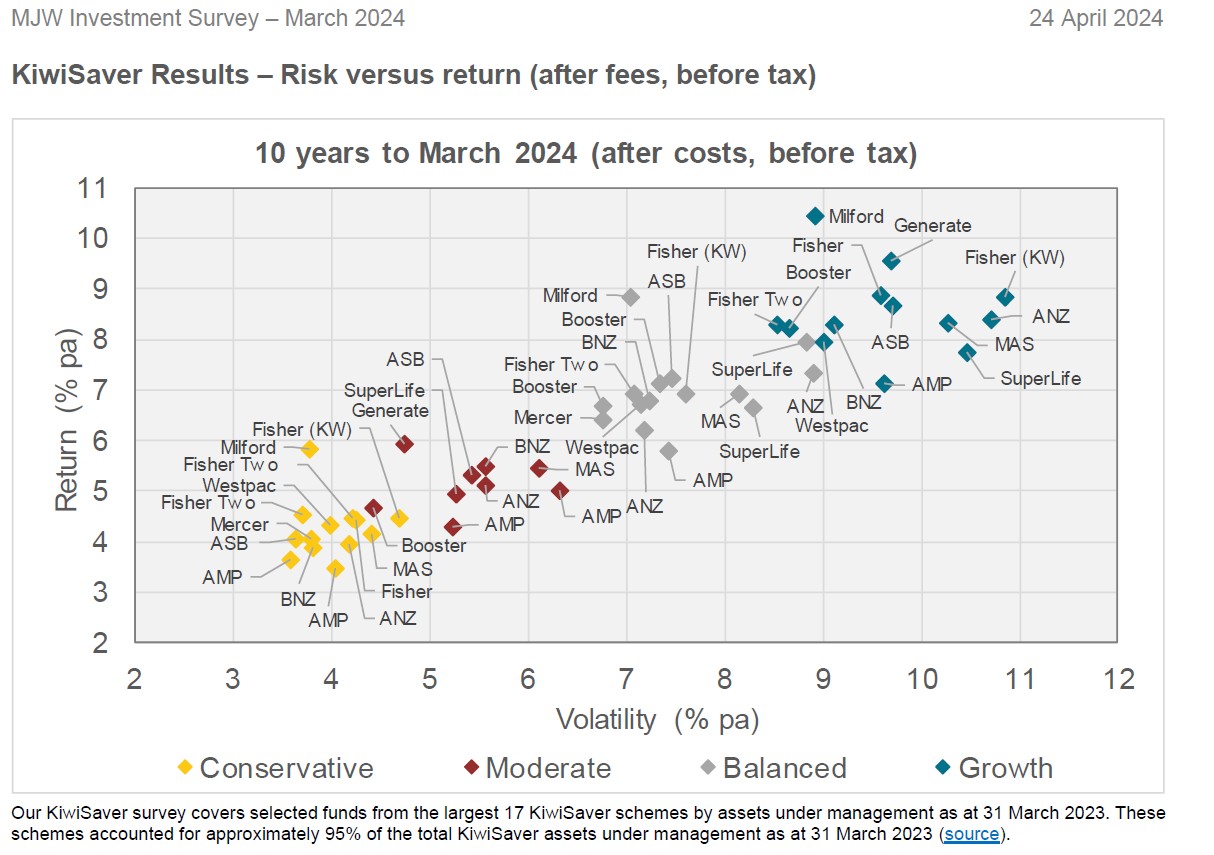

And the Risk/Return graph for the 10 year period for judging your manager against all others in your appropriate risk class. Risk demands a return, you should be getting the best return for at any one level of risk (volatility).