Pulling out a conversation started by @geek3001 from the Paywave fees are too high thread, prepare to be super surprised...

geek3001:

gzt: Anyone here will be super-surprised if any NZ bank really does that. If you name the bank and specific card the most likely thing that will happen imo - someone here using the exact same card will tell you you're at least partially mistaken about it.

Fair comment, however, with respect I don't believe I am mistaken.

I have re-checked my card activity and have confirmed that I have used the card twice, the first time for an online transaction which completed without any challenges, and the second time for a payment in a supermarket where contactless payment went through on the first attempt with no requirement to insert the card and enter a PIN.

The credit card I have been sent is effectively fully functional upon receipt - no need to activate it.

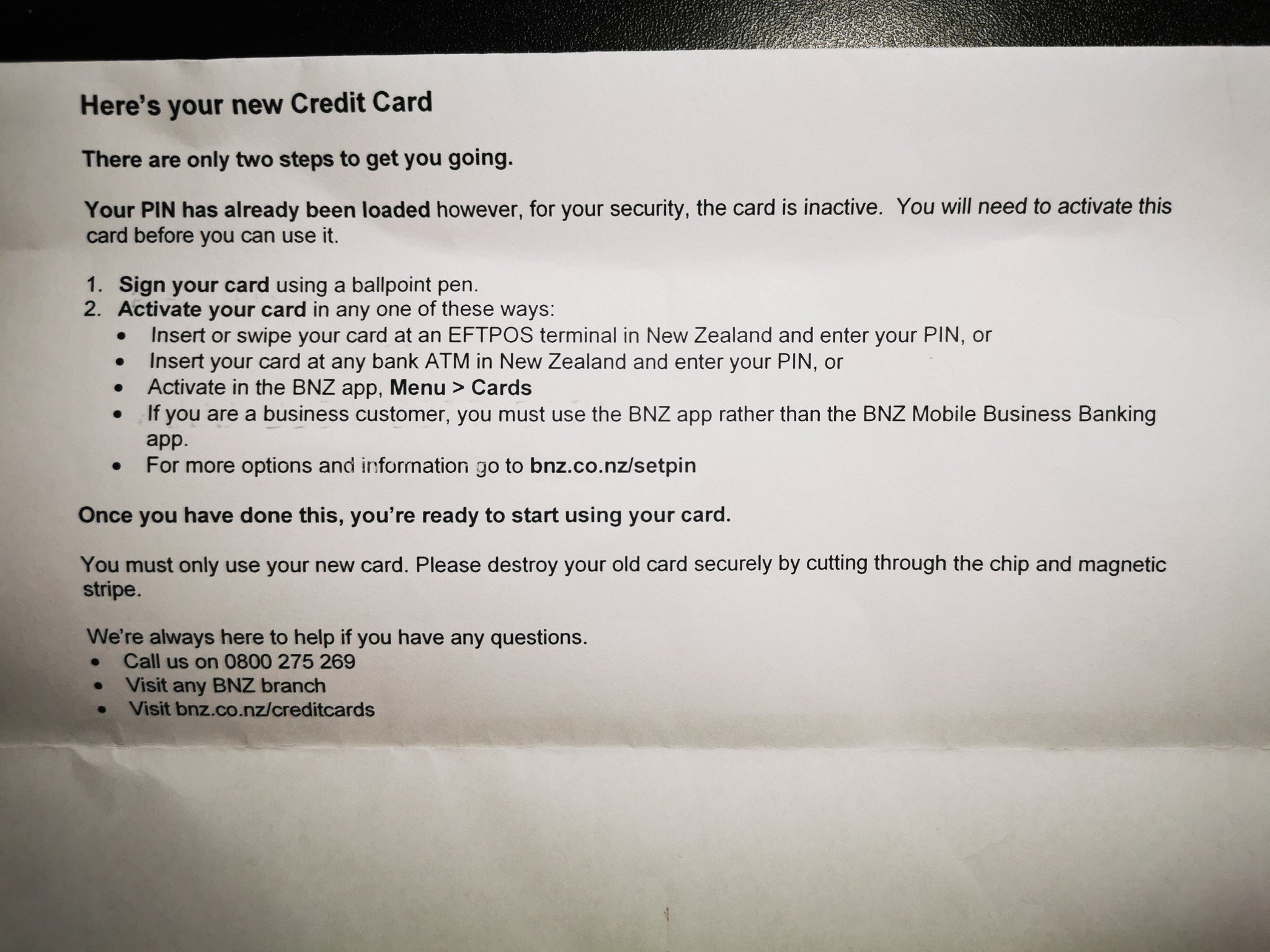

The letter accompanying the new card had three instructions:

1. Sign the back of your new card.

2. Your PIN is the same as your previous card.

3. Good to Go! Your new card is ready to use.

There was no instruction to activate the card.

I have a 'please explain' query lodged with the bank, as I suspect something has gone very wrong with the card issuing process.

My original post above was intended to offer a view that some card fees were to an attempt to collect funds to help with refunds for fraudulent charges caused in part by my current card reissue experience - I now fear I have hijacked this thread, so apologies, better get back on topic.

Just confirming that I have experienced exactly the same scenario.

My brand new card arrived earlier this week, and I intentionally tried to use it via paywave for $130 expecting to have to put in my chip/pin.

It went through without an issue.

I did however receive a text from the bank: "We see you've started using your new card ending xxxx with a transaction for $130 at YYYYY. Please reply NO if this was not you."

So not entirely unsafe/hopeless, but still a change from the status quo - and anybody who intercepted the card could have started using it