Going to explain this the best I can, its one of those things that could be much more understandable when spoken - not typed!

I have always split my mortgage in to two portions, one fixed and the other offset.

I usually set the offset balance to what I expect to have save at the end of the fixed term, when I restructure and do the same again.

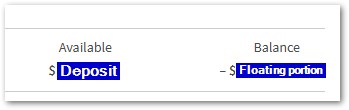

For example my mortgage could be 200k, i have 40k in savings, I fix for 6 months 150k and offset the remaining 50k.

I am then paying a low-ish rate on the fixed portion, and a high rate on the offset portion, but only 10k of that portion as my savings of 40k is off setting 40k of the offset debt.

I choose these numbers because I believe that in 6 months the offset mortgage would have reduced by 5k due to repayments and my savings would have increased by 5k to 45k - meaning that at the END of the fixed term my offset debt would be fully offset and incur no interest costs, even towards the end of the fixed term the interest costs on the offset account would be minimal.

Then when it's time to fix again I restructure the amounts and do the same again.

My question is, is this the best way to do things? the only other option I see is to set the offset balance at what my savings are at the START of the term, this way there would be no interest charged on that portion at all but the catch would be as the repayments knock that debt down and my regular savings increase I would have a portion of cash sitting in that savings account which is not offsetting anything, nor would it be earning interest as that savings account is set up to offset my mortgage and therefore does not earn interest.

I understand I could put any cash from the savings account above the balance of the offset balance into a savings account, even though the returns are so low anyway.

I am trying to work out what the better option is here, set the offset balance to where I think my savings will be sitting in 6 months time when the term is up (factoring in the repayments reducing the debt balance also), trying to get the offset balance and savings balance to be the same at the end of the term, or setting the offset balance to be what my savings are at the start of the term and then putting any cash above the offset balance into an interest earning account?

The numbers and balances are hypothetical to simplify things and I understand the difference between the interest rate of the offset account (6.75%) and returns on savings account (about 2.8%) would be a factor, along with the 28% tax on returns but I think this gap would stay roughly the same as interest rates go up and down.