sleemanj:davidcole:

OFX already handles all of this. In NZ only ASB (I think) implement it, and then it's only for statement export. Bu tin reality, OFX (Open Financial Exchange) covers payments exports everything between apps and banks.

http://www.ofx.net/DownloadPage/Downloads.aspx

You have the wrong end of the stick.

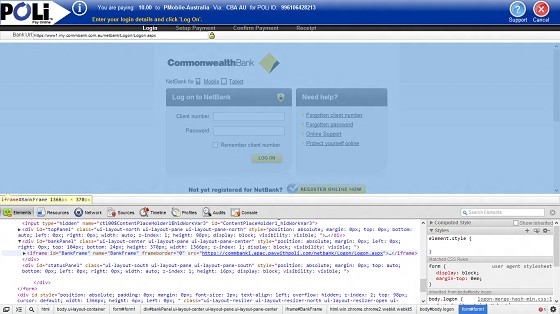

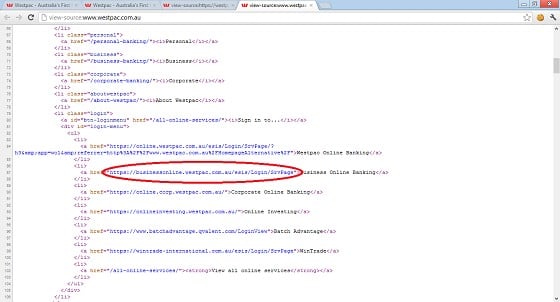

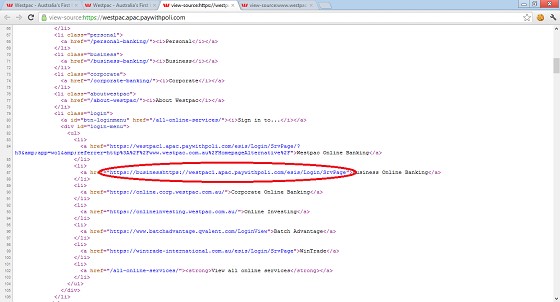

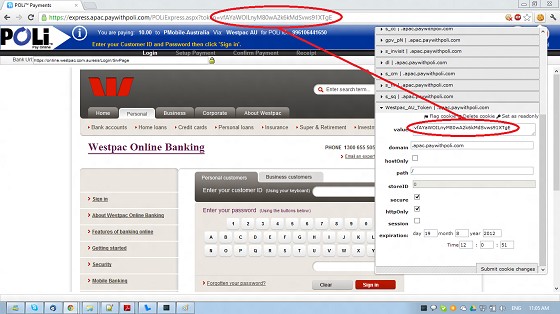

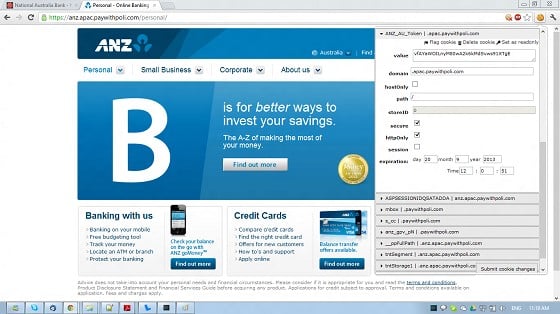

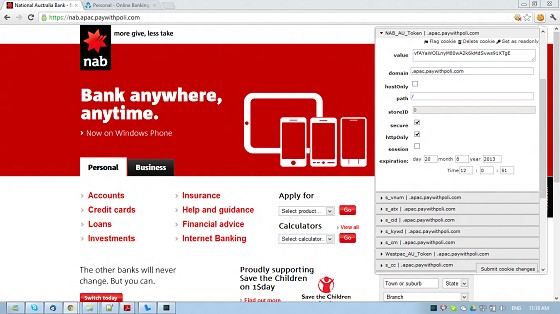

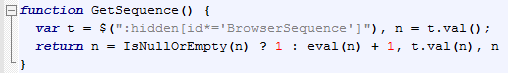

I'm talking about an automated way for customers, people buying things, to be presented a pre-filled-out form, in their ordinary internet banking, to allow them to transfer money to you ("internet banking payment") with a given set of reference, to your specified account.

For example a link "Click Here To Pay With Yourbank Internet Banking", goes to the customers bank, the customer logs in, and they are presented with their normal type of make payment form but already completed with the details they need to provide.

OFX is about downloading transactions from your account, to your application, or indeed in some cases feeding the other direction. It's not about a customer initiating a payment.

No actually it is: http://www.ofx.net/AboutOFX/ServicesSupported.aspx

From Link:

Intrabank Funds Transfer

OFX supports transferring funds between two accounts at the same financial institution. Funds transfers in OFX can be immediate or scheduled. Scheduled transfers can repeat at specified intervals.

Interbank Funds Transfer

The “interbank funds transfer add request” provides a way for a clients to set up a single transfer between accounts at different financial institutions. Like intrabank funds transfers, the request designates source and destination accounts and the amount of the transfer. Also, as in the intrabank funds transfer, the FI must be able to authenticate the source account. However, interbank funds transfers differ from intrabank funds transfers in the following respects:

- The routing and transit number of the destination account differs from the source account.

- At the discretion of an FI, the destination account can be subject to pre-notification.

- Source and destination accounts must be enabled for the Automated Clearing House (ACH).

Like I said, just not done over here. Used fairly extensively in the States. If you were an MS Money user from way back you would see all the payment functions in the app that were all turned off becuase our banks didn;'t support it.