I've been looking for a local share trading forum and the only one I can see is Sharetrader.co.nz which requires an ISP email address to sign up, how many people still use ISP email addresses?

Maybe there are some savvy share traders here?

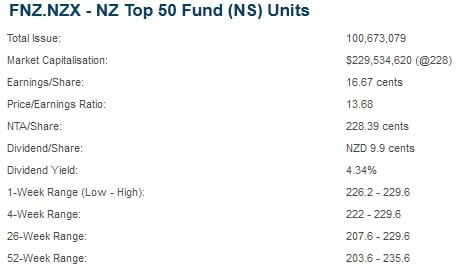

I am completely new to share trading and want to buy some stock on the NZX50, I've just recently completed and have an ANZ Securities account. I've been researching a bit but there is a lot to grasp. I've decided investing in an ETF would be appropriate for a longer term investment and am thinking probably the FNZ Top 50 Fund... Any ETF traders here? What was your approach?

Of course people recommend to diversify your investment profile where is where I'm a little stuck. I'm interested in short term trading and trading for income via dividends also but aren't really sure where to go with that. Can anyone offer any advice? Would be much appreciated.