I'm looking at a notebook computer on Kogan and DSE (same model and price on both; no surprises there). It's advertised respectively as a Kogan Hong Kong and DSE product and there's a reasonably prominent statement that the Hong Kong Terms apply. This includes (from the Kogan version):

respect of any Order, certain taxes may be levied by the destination country to which your Kogan HK Products will be delivered. You will be the importer of record for the purpose of customs and border processing. As the importer of the Kogan HK Products, you agree that you are liable to pay such taxes with respect to the Kogan HK Products to the relevant authority in addition to your payment to us under the General Terms and Conditions above. It is your responsibility to determine whether any such taxes apply in your destination country for delivery or the country from which the Kogan HK Products are shipped...

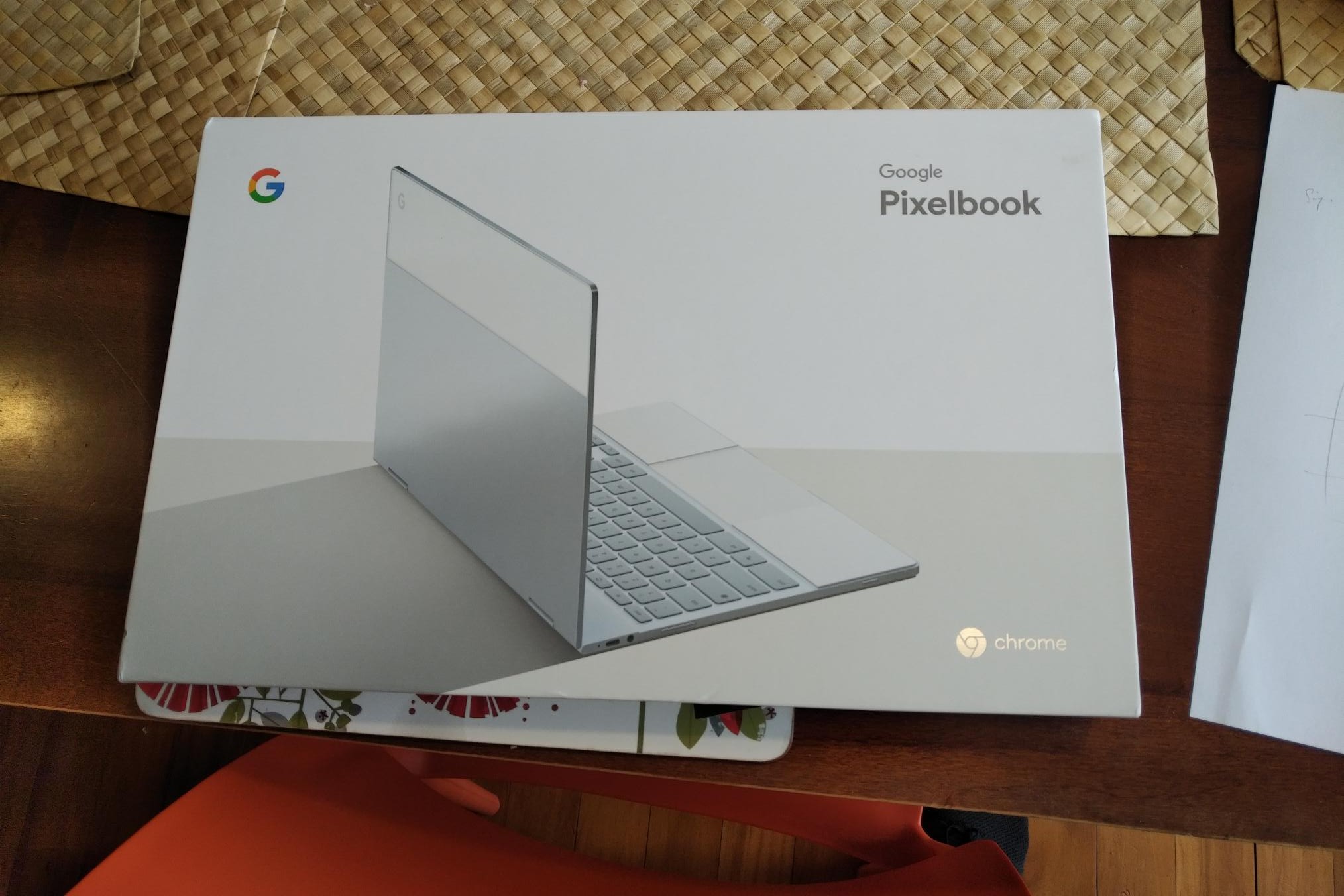

The notebook is approx $1500, so well over the c $400 de facto threshold. Straightforward enough so far and I was trying to work out what the landed price is. But then when you actually add the item and go to check out, the invoice specifies that GST is already included in the advertised $1500.

I'm trying to work out what, if any, NZ fees/taxes would be payable in this case. Is the customs duty still required if GST has already been paid? I've sent an email to DSE querying this but haven't heard anything back and needless to say, now that I've found a product I want, I'm impatient to buy.

Has anyone else bought anything over the threshold either from DSE/Kogan or from another retailer with GST already included?