Hi,

Does anyone here develop mobile apps that earn an income? I'm trying to figure out what my obligations are regarding GST. I'll try calling IRD after the holidays, but my past experience with them hasn't been great so I thought I'd ask for first-hand experience from developers.

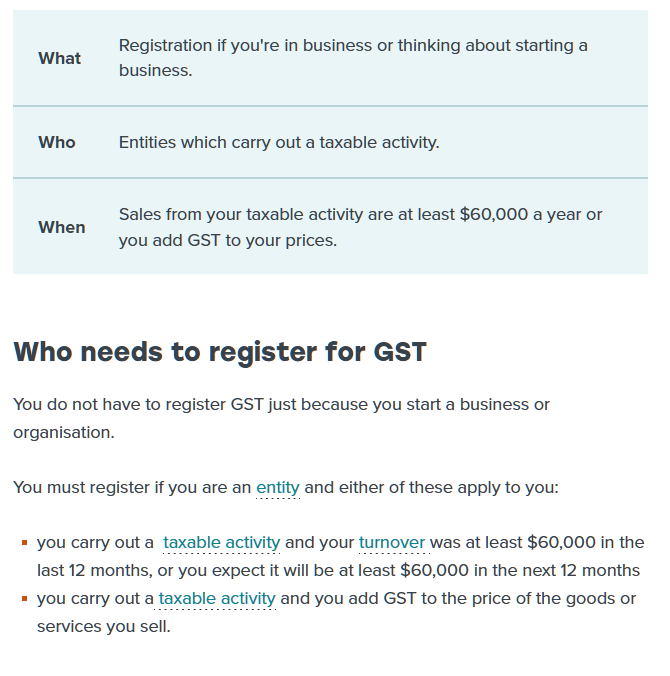

I've just created my first android app and uploaded it to the Google Play Store. It has an in-app purchase. Google removes GST (or sales tax for non-NZ based buyers) and their 30% cut before paying me what's left. My sales are going to be significantly less than the $60K threshold, but the IRD website says if your goods include GST then you need to register. Does this apply for apps sold through an agent like Google who collects the GST themselves?

Any insight would be much appreciated. Thanks!