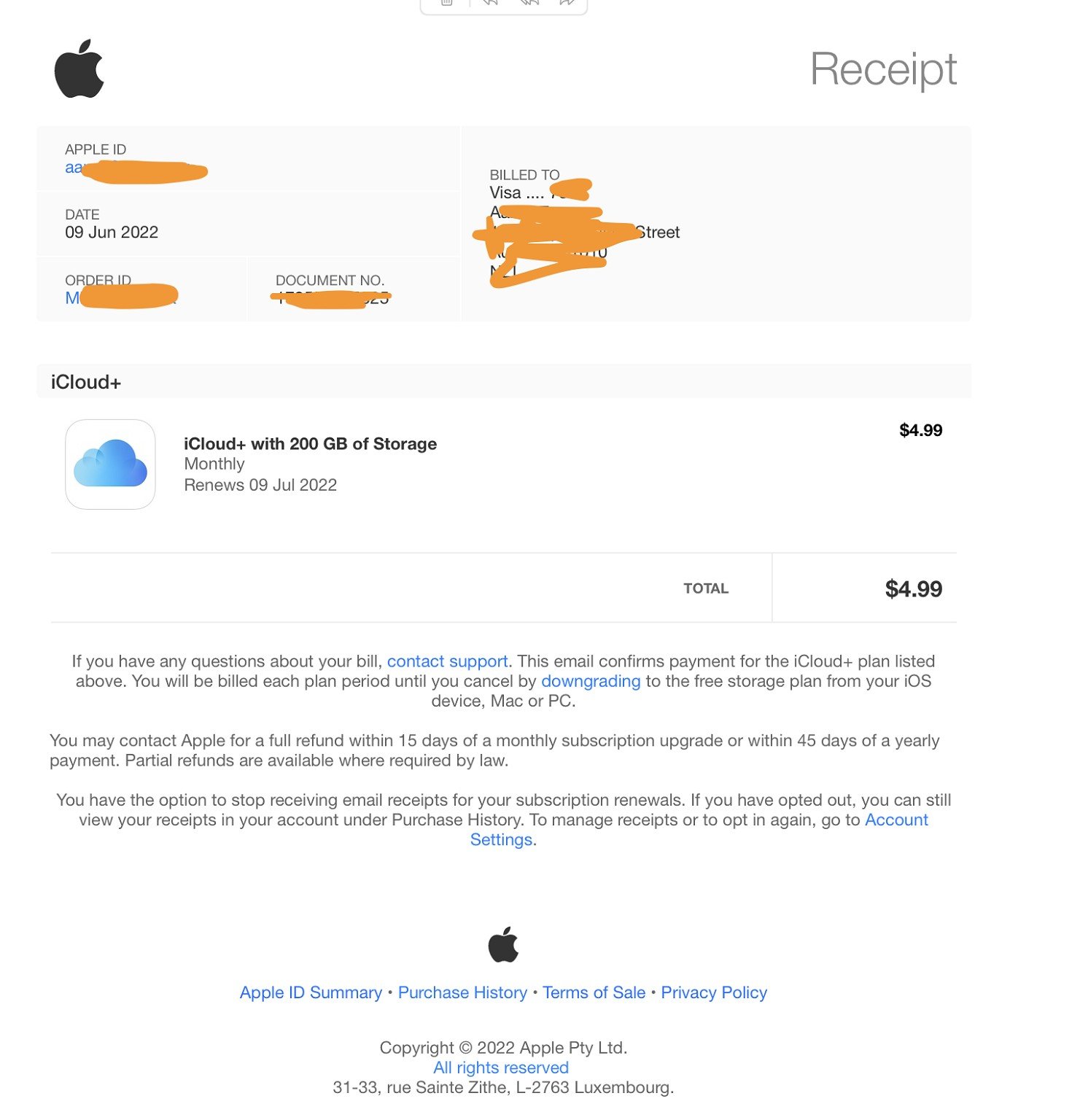

I have an Apple subscription which I use for work (From apple, not a third party app). I was going to add it to my expenses, but noticed there is no GST number on the receipt each month.

Additionally, their menu said "its includes any VAT" instead of GST, but doesn't itemise it either.

Seems little info on this online. Anyone hit the same thing?