|

|

|

my house i bought 20 years ago for 150,000 is now valued at 674,000. i laughed because i live here and there is know way it's worth that yet thats what i will be rated on. Crazy

Common sense is not as common as you think.

heavenlywild:

MikeAqua:

Stuff articles have predicted 276 of the last zero property market reversals.

Sorry, what do you mean? I don't know what you are trying to say, not being sarcastic.

They keep predicting house prices will drop, but they never do.

Mike

vexxxboy:

my house i bought 20 years ago for 150,000 is now valued at 674,000. i laughed because i live here and there is know way it's worth that yet thats what i will be rated on. Crazy

What makes you think its not worth $674k? Because you didn't pay that much for it 20 years ago? It's worth what the market will pay for it and if the valuation is coming in at that value then I have no doubt you would achieve that on the open market if you sold it.

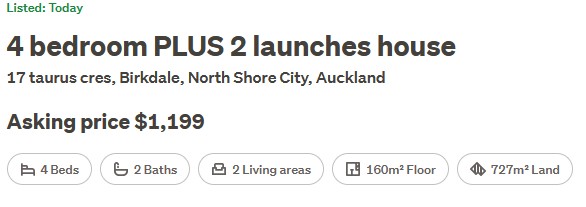

Now this is a house price I can get on board with! 😃

(note: most likely a typo...but still funny) 😄

quickymart:

Now this is a house price I can get on board with! 😃

(note: most likely a typo...but still funny) 😄

Go for it. Put the $198,801 leftover from your deposit towards a heat pump upgrade and 3 new iPhones! That leaves $8 leftover from Apple...

Yeah, typo, and E+OE will apply

MikeAqua:

heavenlywild:

Sorry, what do you mean? I don't know what you are trying to say, not being sarcastic.

They keep predicting house prices will drop, but they never do.

They do drop and have dropped in the past,. But over the long term they should rise. Also in much of NZ prior to a few years ago, there had been little growth in house prices in many parts of NZ for some time, and one could argue that for much of NZ prior to 2018 ish, there wasn't a housing crisis in much of NZ, mainly Auckland and a few other main centres. But the big problem NZ has, is that during covid house prices have risen 40% which I don't think has ever occurred before in recent history. So if that can happen....

Then you need to think about the rising interest rates and the market is already cooling and people negative about things. I heard an article yesterday where someone was saying that Wellington prices may have dropped 10% in the last 3 months.

mattwnz:

They do drop and have dropped in the past,. But over the long term they should rise.

Looking at the sales history of my house, when we bought it 20 years ago, we paid $218k (which was a stretch for us at the time - we were both only earning about $30k each), but the previous owner had paid $240 for it and the owner before that had paid $222 for it, so yes - prices have gone down in the past, but the market hasn't been like that often and it's not currently like that.

Of course this same house with minimal improvements has risen in value of the last 20 years and is now worth around $1.30m and rising. Seems ridiculous.

If house prices dropped it wouldn't be people like my wife and I that would be really affected. It would be those that bought over the last few years at high prices and haven't made crazy capital gains.

With that said - we have friends who did what we thought was foolish last year in lockdown - they mortgaged themselves to the hilt for their dream home and paid $1.4m for a McMansion. They are paying interest-only as they couldn't afford to pay back any principal. I thought that was pretty dumb at the time.

It's now valued (on paper) a little over a year later, at $2.2m.

They will be hoping that i there is a correction in house prices that it's a small one and they can still realise a decent capital gain on this property to keep the wolves at bay. As it stands, $800k in 15months is a pretty significant capital gain and I believe unsustainable.

Handsome Dan Has Spoken.

Handsome Dan needs to stop adding three dots to every sentence...

Handsome Dan does not currently have a side hustle as the mascot for Yale

*Gladly accepting donations...

^The above story is much more common than people think or want to realise. 500k - 800k gains over the past year is absolutely the norm at the moment.

Unsustainable? I don't know. If it were unsustainable then people would stop buying, yet people are still buying at the current higher rates.

Buying a Tesla? Use my Tesla referral link and we both get discounts and credits.

heavenlywild:

^The above story is much more common than people think or want to realise. 500k - 800k gains over the past year is absolutely the norm at the moment.

Unsustainable? I don't know. If it were unsustainable then people would stop buying, yet people are still buying at the current higher rates.

It's unsustainable because it would rely on interest rates continuing to decrease forever. It's becoming increasingly clear that we've hit the bottom of that cycle.

alasta:

heavenlywild:

^The above story is much more common than people think or want to realise. 500k - 800k gains over the past year is absolutely the norm at the moment.

Unsustainable? I don't know. If it were unsustainable then people would stop buying, yet people are still buying at the current higher rates.

It's unsustainable because it would rely on interest rates continuing to decrease forever. It's becoming increasingly clear that we've hit the bottom of that cycle.

Yeah, I just can't see how prices can continue to rise too much more at the moment, when interest rates are now on the way up again. IMO wages would need to increase, or banks would need to issue mortgages for longer. Or something else would need to occur. In the UK, banks including international banks, are becoming landlords and buying up houses and I know they also have a lot of overseas buyers snapping up houses, and I understand in NZ the number of owner occupiers as a percentage are dropping. We had the problem of international buyers buying up NZ properties prior international buyer ban came in, but it came in too late, as by that time NZ houses stopped being bargains. Now it is the cheap money and lack of supply on the market that is pushing up prices. But supply appears to now be increasing a lot with some record listings.

heavenlywild:

^The above story is much more common than people think or want to realise. 500k - 800k gains over the past year is absolutely the norm at the moment.

Unsustainable? I don't know. If it were unsustainable then people would stop buying, yet people are still buying at the current higher rates.

Yes I know of someone who purchased a house for just over a million in the Wellington regions. Sat on it for a year and sold it for well over 1.6 million. So it was a capital gain of over 600k. Plus the selling price was double what it sod for just 3 years ago, no changes made. Made more than many people would earn in 5-10 years. Being a house in the last few years would be the best job, you can just sit there and look pretty and earn all that money. I have heard of peolpe borrowing against that increased equity, as apparently banks will then lend more.

mattwnz:

Yeah, I just can't see how prices can continue to rise too much more at the moment, when interest rates are now on the way up again. IMO wages would need to increase, or banks would need to issue mortgages for longer. Or something else would need to occur. In the UK, banks including international banks, are becoming landlords and buying up houses and I know they also have a lot of overseas buyers snapping up houses, and I understand in NZ the number of owner occupiers as a percentage are dropping. We had the problem of international buyers buying up NZ properties prior international buyer ban came in, but it came in too late, as by that time NZ houses stopped being bargains. Now it is the cheap money and lack of supply on the market that is pushing up prices. But supply appears to now be increasing a lot with some record listings.

Agree. prices can rise to a point where enough buyers will pay, that has to be decreasing. Wages won't increase. Even if banks made 60 year mortgages (an idea I put forward way back) its too late for that now as all that does is halve the principal payment, the vast bulk of a new mortgage is interest. Supply is happening, Ive seen two articles of large developments lately. What may happen is Auckland may stabilise as many seem to be leaving Dodge for a lower cost town. So lower cost towns, which probably dont have large developments planned or needed, will probably rise heavily

The key is large developments, and without looking for any Ive seen two articles. Maybe planned developments need to be more publicised, even if just in the feasibility stage, to get people talking and enquiring. Every new build leaves an empty house with no default occupier, which moves us past "A buys from B, B buys from C, C buys from A"

heavenlywild:

^The above story is much more common than people think or want to realise. 500k - 800k gains over the past year is absolutely the norm at the moment.

Unsustainable? I don't know. If it were unsustainable then people would stop buying, yet people are still buying at the current higher rates.

Yep, I could sell my AKL house for a fat profit, and move to a lower priced town and be happy to pay a price that is 50% higher than what it was last year. Knowing that others like me will push the price up in the future, plus I'd be cashed up and in a better home. Thats the domain of owners. But as supply ramps up and it seems to be happening that will ease things, but that's a way off yet

tdgeek:

quickymart:

Now this is a house price I can get on board with! 😃

(note: most likely a typo...but still funny) 😄

Go for it. Put the $198,801 leftover from your deposit towards a heat pump upgrade and 3 new iPhones! That leaves $8 leftover from Apple...

Sadly the price has been corrected - $1,199,000 now. What a place to make a typo! 🙃

|

|

|