|

|

|

I'm thinking of buying a house in Florida and spending 4 or 5 months a year there when I retire. It's about the same as buying a house here with warmer weather, warmer sea and no state income tax!

Geektastic:

I'm thinking of buying a house in Florida and spending 4 or 5 months a year there when I retire. It's about the same as buying a house here with warmer weather, warmer sea and no state income tax!

And hurricanes and sinkholes!

Plus all the Trump fanboys 🤮

I was seeing a commentator say that house prices shouldn't crash as it would devastate the economy. But it got me wondering - I don't remember house prices being anywhere near as ridiculously high in the 80s, 90s or even the 2000s - yet the economy didn't crash majorly then.

Did rapidly rising house prices push or move something else out of the economy to take its place instead? If so, what was it? Farming? Manufacturing? Tourism (pre-coronavirus)?

quickymart:

Plus all the Trump fanboys 🤮

I was seeing a commentator say that house prices shouldn't crash as it would devastate the economy. But it got me wondering - I don't remember house prices being anywhere near as ridiculously high in the 80s, 90s or even the 2000s - yet the economy didn't crash majorly then.

Did rapidly rising house prices push or move something else out of the economy to take its place instead? If so, what was it? Farming? Manufacturing? Tourism (pre-coronavirus)?

Mortgage rates were quite higher in the past and that can significantly impact how big loan you can service from an income. But this is only part of a complex problem.

Just a very simple example (let's take inflation out of the equation).

$200K loan for 20 years.

If you take the pretty low 2.5% which was available for quite some time recently, it's $488 / fortnight with $296 principal and $192 interest at the first installment.

If this would be a 20% interest loan, it's $1567 / fortnight with $29 principal and $1538 interest at the first installment.

The total amount of money you are paying back over the 20 years is also significantly larger (3.2 times higher) with 20% interest.

Even the income to house value ratio was lower in the past, the higher interest rate still made the house purchase more expensive.

As mentioned quite a few times, don't expect the house prices to drop significantly. They can stay at a similar level for years and at some suburbs, they might drop by a few percent.

If you would like to buy a house, there are still quite a few ways:

- Increase your income and ramp up savings so you get closer to the deposit

- Don't just leave the deposit sitting on your account for years, inflation is chewing into it, and the term deposit rates are just nothing. Put the savings into some ETFs or other assets which produce some return.

- Buy a property at a cheaper region, rent it out and try to pay it back as soon as possible, so you are on the property ladder and you are already gaining with the price increases

Combination of the 3 above :)

quickymart:

Plus all the Trump fanboys 🤮

I was seeing a commentator say that house prices shouldn't crash as it would devastate the economy. But it got me wondering - I don't remember house prices being anywhere near as ridiculously high in the 80s, 90s or even the 2000s - yet the economy didn't crash majorly then.

Did rapidly rising house prices push or move something else out of the economy to take its place instead? If so, what was it? Farming? Manufacturing? Tourism (pre-coronavirus)?

In your view, what would a realistic house price be after a crash that is affordable?

This thread seems to go in circles a bit. A crash affects everyone, even those without a home. Housing is not an isolated system. Market crashes, banks not willing to lend as peoples jobs are not so secure any more etc. Unless you're cashed up enough to not need a mortgage in a crash my bet is you're worse off than now. Then as the country comes out of a crash, everyone is back in the same boat, prices go back up etc.

The economy didn't crash in the 80s? Or the 2000s?

Interest rates hit something like 21% in the 80's. There were a lot of mortgagee sales. Houses may have been 50k or so but at the same time people were not earning what they are now.

That is true. For me a reasonable price where I could service a mortagage would be in the $400k-$500k range. Before you say "that was a long time ago" it was only about 2017-2018 prices were like that.

I lived in a place in early 2014 that I know the owner purchased a couple of months prior for $433k. That place is worth nearly $980k now, just over 6 years later. It's ridiculous - I don't recall prices racing up like that in the 2000s, or even the (early) 2010s.

It's not about if it was a long time ago, it's if it will go back to that.

If prices went down to 400-500k in Auckland, we could assume Dunedin would be back down to 200k odd for a house. In which case I'll take 3.....the cycle continues.

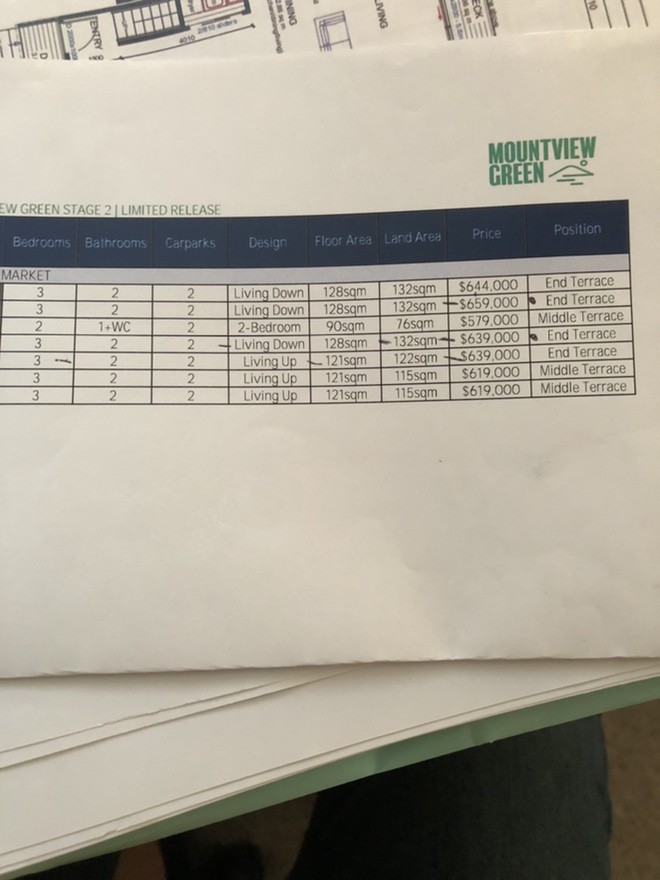

I've placed a 10% deposit to secure one of this 3 bedroom homes down here in Rotorua. Now it seems all those unsold ones are given to Kiwibuild at just $500,000 each.

Now it feels that I've just been robbed $139,000 + $16,000 FHL Grant.

https://www.kiwibuild.govt.nz/available-homes/show/66/mountview-green

The KB one has 1 car park, your image they all have 2, what else might be different? I'm thinking if there are units in the least desirable part of the complex, perhaps.

quickymart:If interest rates at the bank rise to 6 %, how are people going to afford to pay these current prices. A house value is only worth as much as someone is prepared to pay for it. Maybe an overseas buyer via someone in NZ?

That is true. For me a reasonable price where I could service a mortagage would be in the $400k-$500k range. Before you say "that was a long time ago" it was only about 2017-2018 prices were like that.

I lived in a place in early 2014 that I know the owner purchased a couple of months prior for $433k. That place is worth nearly $980k now, just over 6 years later. It's ridiculous - I don't recall prices racing up like that in the 2000s, or even the (early) 2010s.

Houses in some areas are struggling at the moment, I saw one house with a BBO $799, then a month later it was $720, now it is $699. 3 Bedroom semi detached townhouse without issues. But at that price it wouldn't really make financial sense as a rental in the area it is in.

tdgeek:

Geektastic:

I'm thinking of buying a house in Florida and spending 4 or 5 months a year there when I retire. It's about the same as buying a house here with warmer weather, warmer sea and no state income tax!

And hurricanes and sinkholes!

Buy on the Gulf side - Sanibel Island or similar.

Divhon88:

I've placed a 10% deposit to secure one of this 3 bedroom homes down here in Rotorua. Now it seems all those unsold ones are given to Kiwibuild at just $500,000 each.

Now it feels that I've just been robbed $139,000 + $16,000 FHL Grant.

https://www.kiwibuild.govt.nz/available-homes/show/66/mountview-green

Wow, new kiwibuild homes on the Kiwibuild website. I thought kiwibuild homes were allocated, rather than houses that don't sell. So potentially there may not be any kiwi-build ones?

Wouldn't you still get the grant, or is the amount you are paying too high? It is ridiculous that the levels for first home grants etc is not adjusted with house price inflation levels, considering they have all the stats. But I guess it means they don't have to pay out as much.

Those houses with the timber cladding don't look too bad, a pity they don't have the plans on their website.

heavenlywild: Ah... capitalism!

Capitalism without supply constraints and with competition will generally make things cheaper. This is achieved by scale, mass production and well managed supply chains.

But we have supply constraints in land and labour and materials. Logistics are bit of dog's breakfast globally. We have a lack of competition on the materials front. We also undertake lots of small bespoke building projects.

In NZ capitalism allows me to buy a good SUV for 60k (+ govt taxes), but I would struggle to finish and fit out a good kitchen for that amount.

Mike

|

|

|