joker97: Why is our tax so high?

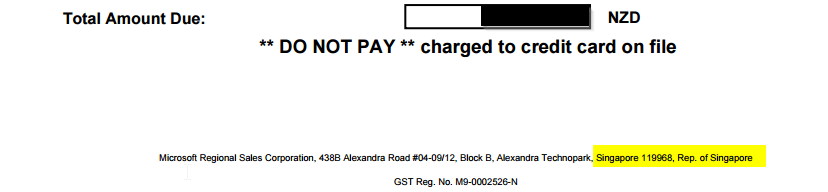

It could be lowered if everyone paid their fair share of taxes. I wonder if NZ reduced the company tax rate to slightly below Irelands, whether we could entice these overseas countries to based their headquarters for tax, in NZ. That could be a solution for NZ, but may annoy a lot of other countries.