afe66: I wonder if this EV ute will quieten the anti EV ute tax brigade if available here in numbers. I'm sure they would claim the clean car rebate and the fringe ben fit tax exception too

https://youtu.be/2E9TUQopIwc

Frankly I doubt it.

At this point a lot of the "ute tax" augment has just become an easy way to attack the government for some.

There will always be something wrong with the EV utes in the eye's of that brigade. And the existence of diesel utes like the LDV T60 bi-turbo 4x4, which loudly advertises "no co2 tax to pay" has done little to deter them.

-----

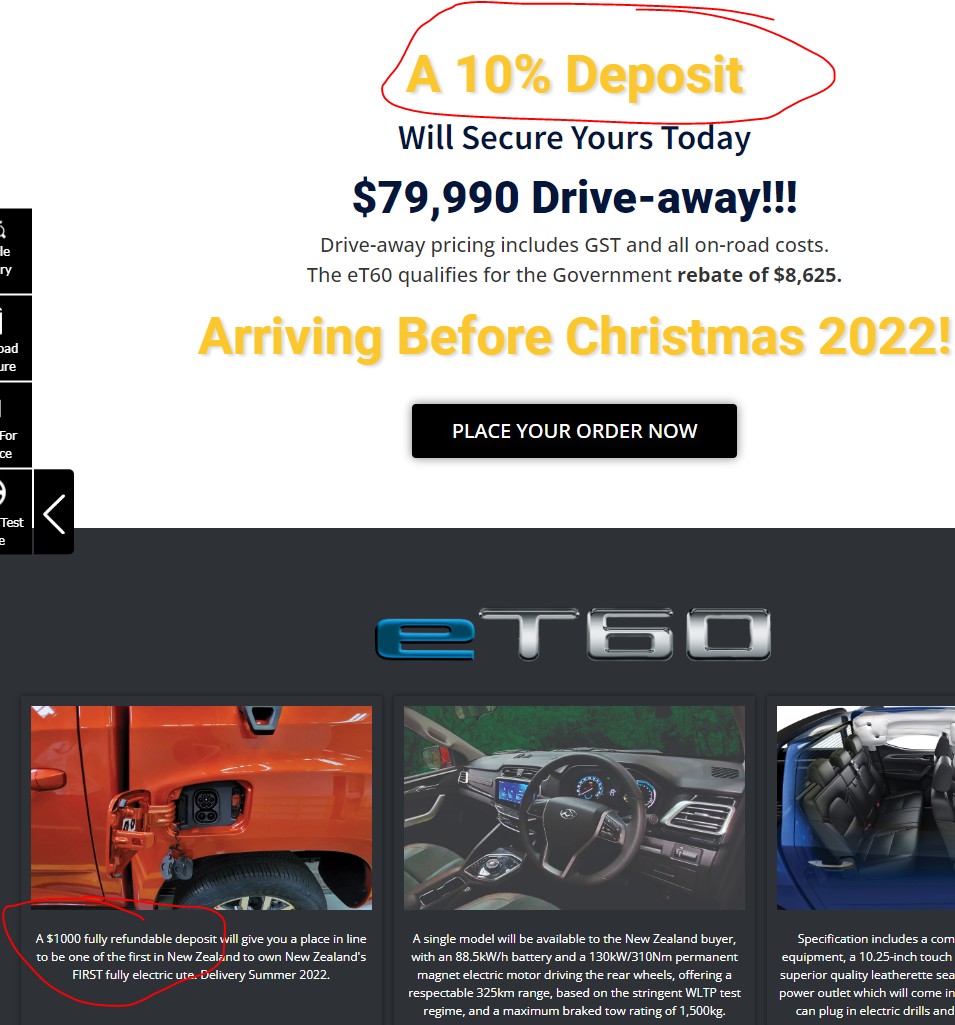

On EV ute's, we have had orders for the LDV eT60 open for quite some time now. The website has arrived before Christmas 2022 in large letters.

Sadly the website / marketing isn't that reassuring:

- Conflicting information on main landing page regarding deposits.

- When you click the order link there is a note that the wheels shown in the images (the same ones shown in the prior landing page & on the spec sheet, are an optional extra)

- Spec sheet still has the same issues it has had for months

- shows a front-mounted format motor in the image but states RWD

- Inconsistent power numbers (150kW / 130kW)

- Output rating of AC ports not disclosed (but website mentions uses drills as the example, so it should be at least 600W)

But on the positive side, questions will go away when deliveries start which is soon.

Frankly the eT60 is likely to appeal more to the anti ute tax brigade, as it is a closer match to the common Thai-built utes. Body on frame, passable ground clearance, solid rear axle, styling like peers. Still, critics will point to the obvious issues: slow DC charging, unsprung motor, poor payload, poor tow rating, poor range etc.

-----

On the Radar RD6, this is unibody (car based vehicle). Gives a lot of advantages, but perceived as less durable, and means the likes of fitting a flat deck is off the menu. Also it is a little smaller.

Similar to the Ford Maverik, which is sold in north America, but no here.

Like the Maverik, the RD6 will likely appeal more to lifestyle buyers (granted a big segment of ute buyers), and like the Maverik it is likely set up to better suit that market. Giant sun roof would be the first example, not a feature that fleet buyers target... It has full independent suspension (better for comfort), and likely has a softer suspension setup (and less payload). Ground clearance is low, but unlike the LDV, AWD is offered. Launch version is going to be 200kW RWD, with cheaper 149kW and (I assume) AWD 298kw versions to come. The latter has roughly double the power of a current Hilux.

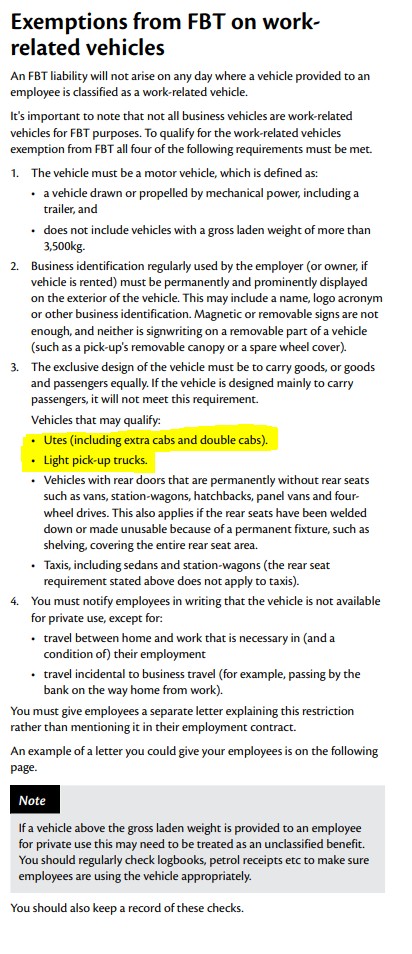

I imagine it would sell well if offered here (especially if they can get the AWD under the rebate cap). People have various reasons for buying utes (everything from wanting the FBT advantages, to appearance, to wanting to keep their smelly / dangerous / dirty things out of the cabin), and a I imagine a decent chunk are wiling to give up the likes of payload for better ride comfort.