ajobbins:

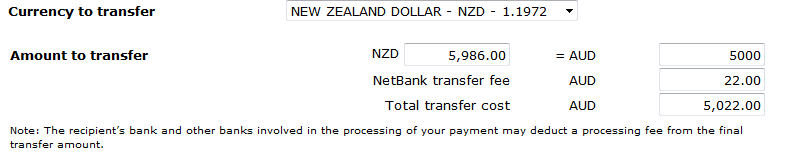

Actually, it isn't easier. I bank with ASB in NZ and CBA in AU. If you want to send money between the two it's a SWIFT payment like every other bank. It's no faster and frankly the rates are terrible.

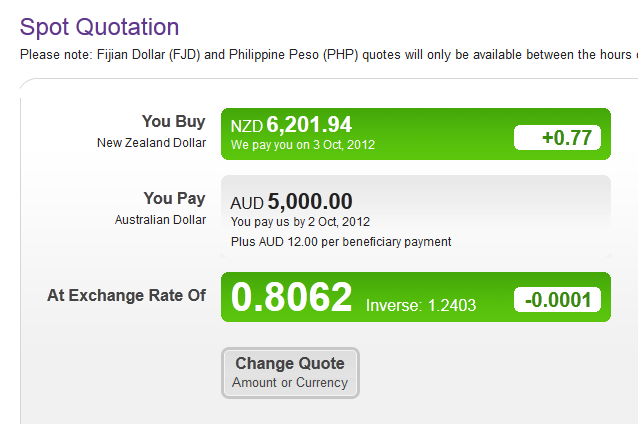

I get a MUCH better rate from a third party company. (Last time I transfered a few thousand, the difference was over $100 between using a 3rd party or using the banks direct)

Was that through Forex? CommBank have cut the fees to $0 for transfers over there, but there's still a $20 transfer fee at this end. Still alright though. At least I'll have matching yellow cards. None of the disgusting ANZ blue!

.

. .

.